Unlocking Corporate Donations: Employer Appending Explained

When it comes to corporate philanthropy, knowledge truly is power. Yet one of the most significant barriers nonprofits face in securing corporate matching gifts is a simple one: they don’t know where their donors work. Without employer data, even the most generous matching gift programs go untapped, leaving thousands—or even millions—in potential donations on the table. That’s where employer appending comes in.

In this post, we’ll break down what employer appending is, how it works, and why it matters—plus how your nonprofit can use it to boost results with minimal lift. Specifically, we’ll cover:

- What is employer appending?

- How does employer appending unlock corporate donations?

- Other benefits of employer appending for nonprofits

- How the employer appending process works

- Employer appending best practices for fundraisers

This powerful data enhancement strategy helps organizations match their donor records with accurate employment information, enabling smarter outreach and maximizing eligibility for corporate giving programs. Whether you’re trying to grow your matching gift revenue, identify prospects for corporate sponsorships, or simply deepen donor relations, employer appending is the key that can unlock an entirely new stream of funding.

What is employer appending?

Employer appending is the process of enriching your donor database by identifying where your supporters work. More specifically, it helps fill in missing employment information using third-party data sources. This process allows nonprofits to uncover corporate affiliations that donors may not have provided during the donation or sign-up process.

Why is this important? Because employment data opens the door to powerful corporate fundraising opportunities, especially when it comes to workplace giving. If you don’t know a donor’s employer, you can’t inform them of their matching gift, volunteer grant, or payroll giving eligibility, meaning you could be leaving free money on the table.

In short, employer appending gives your organization the knowledge it needs to unlock corporate dollars that would otherwise be missed, all without needing to ask donors directly for their employment data.

How does employer appending unlock corporate donations?

At its core, employer appending bridges the gap between donor generosity and corporate giving potential. By uncovering where your donors work, this process allows your nonprofit to tap into billions of dollars in available matching gift funds, broader workplace giving, and corporate social responsibility (CSR) programs. In other words, funding that would otherwise go unclaimed.

Here’s how it works:

Employer Appends Identify Workplace Giving-Eligible Donors

Many donors don’t indicate their employer when making a gift, and, as a result, are unaware that their companies offer donation matching or payroll giving programs.

Employer appending fills in those blanks, helping you proactively identify donors whose employers offer matching gift programs and other CSR benefits.

Employer Appends Enable Personalized Workplace Giving Outreach

Personalized messaging drastically increases the chances that donors will take action and ultimately participate in their companies’ workplace giving programs. Once you know where a donor works, you can tailor your follow-up emails, thank-you messages, and campaign appeals to include employer-specific workplace giving information.

With a workplace giving database and automation tool in tow, you can even provide supporters with direct links to their employers’ program submission portals!

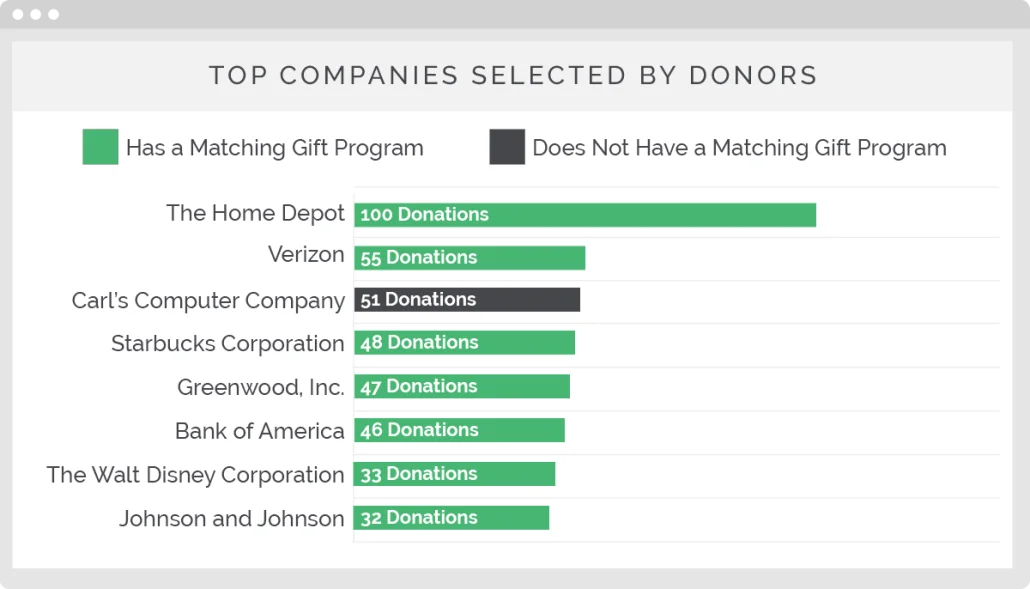

Employer Appends Strengthen Your Corporate Partnership Strategy

When your team is equipped with supporters’ employer data, you can use this information to identify which companies are most represented in your donor base.

This insight can then guide your outreach for in-kind donations, sponsorships, employee engagement, volunteer grants, and future collaborations. You might even see if a donor who works at a particular company would be willing to advocate for a partnership on your behalf!

Other benefits of employer appending for nonprofits

While unlocking corporate donations is a powerful incentive, employer appending delivers a range of additional benefits that go beyond workplace philanthropy. By enriching your donor database with accurate employment information, your organization can make more strategic decisions, improve outreach, and deepen relationships in ways that drive long-term value.

Here’s how:

Enhanced Donor Segmentation and Personalization

Knowing where your donors work allows you to tailor messages to specific industries, job roles, or company cultures. Whether you’re inviting donors to a networking event or highlighting relevant volunteer opportunities, employment data helps you craft messages that resonate well.

Improved Prospect Research and Major Gift Identification

Employer info offers valuable context when evaluating a donor’s giving capacity or potential influence. A donor employed at a Fortune 500 company, for example, may be a strong candidate for helping initiate or facilitate corporate partnership outreach. Understanding where your donors work allows you to strategically align outreach efforts with organizations where you already have an inside connection or influence.

Increased Donor Retention and Engagement

Sending employer-specific matching gift reminders, volunteer opportunities, or company recognition can make donors feel seen and appreciated. Personalized engagement increases the likelihood they’ll give again and stay involved over time.

Stronger Reporting and Impact Demonstration

With detailed employer data, you can better demonstrate the reach and influence of your donor community to board members, funders, and partners. This makes your organization appear more data-driven and prepared for long-term growth.

In short, employer appending empowers smarter fundraising, sharper marketing, and stronger relationships, making it a valuable investment for nonprofits aiming to grow sustainably and strategically.

How the employer appending process works

Employer appending might sound technical, but the process is straightforward, and the payoff can be significant. In just a few simple steps, your nonprofit can transform incomplete donor records into a powerful tool for unlocking corporate donations and improving donor engagement.

Here’s a breakdown of how the employer appending process works:

1. You Gather Donor Data

The first step in completing an employer append is to compile a list of donors whose employment information is missing or outdated. Most nonprofits provide a data file that includes basic identifiers such as these:

- Full name

- Email address

- Mailing address or ZIP code

- Phone number

Keep in mind that the more accurate and complete your data is to begin with, the better the results of the append.

2. You Submit the List to a Data Append Provider

You’ll send your file to a trusted employer appending service. Double the Donation is one company that helps provide donor data to its customers. Employment data providers use sophisticated databases and matching algorithms to cross-reference your donor records with verified employment data sources.

3. They Match Donors with Likely Employers

The provider analyzes your file and returns a list of donors matched with their most likely current employer, often accompanied by a confidence score or match level. Some providers also flag which companies offer matching gifts or other corporate giving programs, turning donor insights into real revenue opportunities.

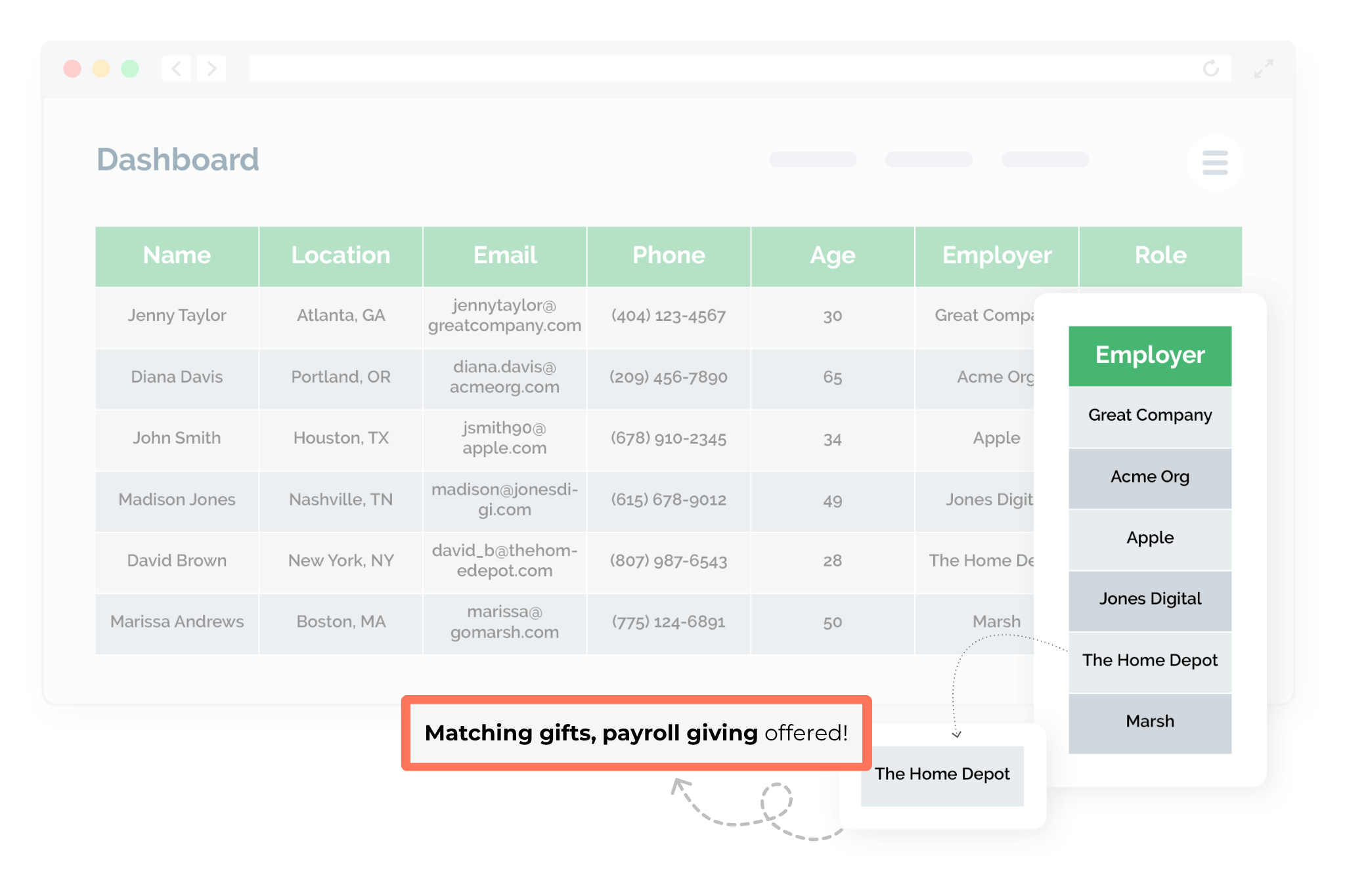

4. You Update Your CRM or Donor Database

Once you receive the appended data, you’ll import it into your CRM or donor management platform. From there, your fundraising and marketing teams can segment and personalize outreach based on newly uncovered employer information.

5. You Take Action to Unlock Corporate Gifts

With accurate employer data in hand, your team can send targeted workplace giving appeals, follow up with eligible donors, and even explore new corporate partnership opportunities.

The employer appending process is a one-off effort that can yield long-term benefits, making it one of the smartest investments for nonprofits looking to grow sustainably. The result? More complete data, stronger outreach, and a greater share of the corporate donations your organization deserves.

Employer appending best practices for fundraisers

To get the most out of an employer append, and avoid wasted effort, it’s essential to follow a few best practices. By approaching the process strategically, fundraisers can ensure actionable data that leads to more corporate donations, stronger engagement, and smarter decision-making.

Here are some key expert-proven tips to implement in your strategy:

Start with clean, accurate donor data.

Before appending, take time to clean your donor list. Remove duplicate records, fix any formatting issues, and verify that contact information (especially email and mailing addresses) is current.

Clean inputs, and effective data management, lead to more reliable appending results.

Choose the right employer append service for your needs.

Not all employer append services are made equal, so it’s important to find one that fits your organization’s goals, data needs, and tech stack.

As you begin, look for a provider with high match accuracy, clear confidence scoring, actionable workplace giving information, and compatibility with your existing tools and systems. Prioritize vendors that follow strong data privacy standards and offer responsive customer support to guide you through the process.

Whether you’re focused on workplace giving or broader donor insights, the right partner can make your append far more valuable.

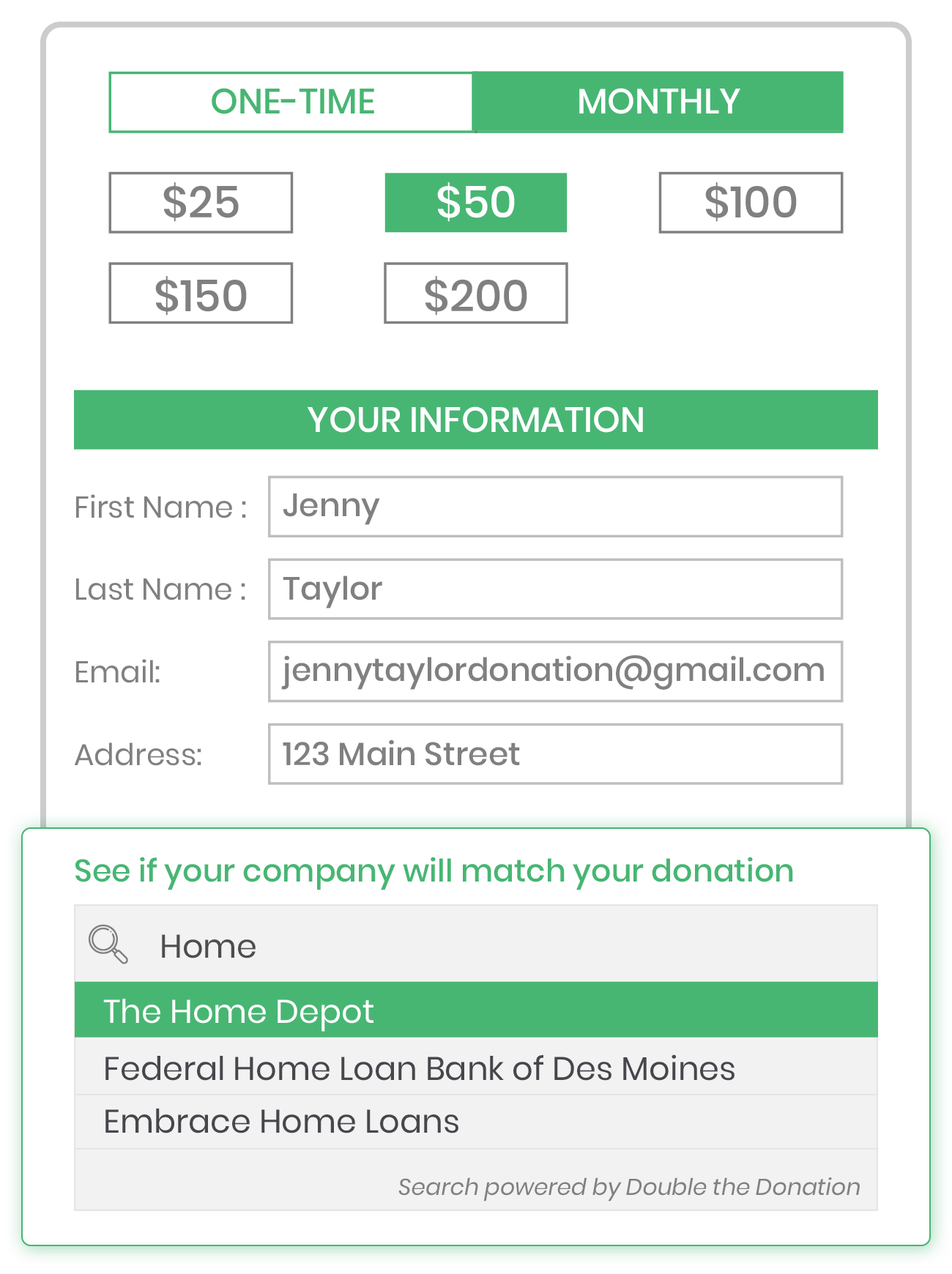

Supplement employer appends with supporter-provided information.

Employer appending is powerful, but it works best when combined with direct input from your donors, too. For the best and most up-to-date results, add optional employer fields to donation and registration forms and explain why they matter, highlighting the opportunity for matching gifts to boost response rates.

From there, you can even follow up with donors who leave the field blank, offering them easy ways to update their information at a later time via follow-up email. When you merge appended data with donor-reported info, you’ll get a more accurate, trustworthy dataset to guide your outreach.

Take an actionable approach to the data you receive.

Don’t just collect employer info—use it to your advantage. Start by identifying donors whose companies offer matching gifts or other workplace giving programs. Then, build tailored outreach that includes employer-specific instructions, submission links, and deadlines. Use segmentation to prioritize high-value opportunities and track follow-through.

Taking action on your data ensures it doesn’t sit unused and helps you translate information into increased revenue and donor engagement.

Wrapping Up & Additional Employer Appending Resources

As more companies expand their commitment to corporate social responsibility, the opportunity for nonprofits to benefit from employer-driven donations has never been greater. But you can’t tap into these funds if you don’t know where your donors work.

By incorporating employer appending into your overall fundraising strategy, you’re not just enriching your database—you’re opening the door to new matching gift revenue, stronger donor engagement, and deeper corporate connections. With the right tools and practices in place, employer appending can help transform anonymous donations into actionable insights that move your mission forward.

Interested in learning more about employer appending for nonprofits and schools? Check out these additional resources:

- What is Data Appending? Basics, Benefits, and Best Practices. New to data appending? This beginner-friendly guide breaks down what it is, how it works, and why it’s essential for a complete donor database.

- Is an Employer Append Right for Your Nonprofit? How to Know. Wondering if employer appending is worth the investment? This post outlines the key indicators that your organization may benefit from.

- Avoid These 5 Employer Appending Mistakes Nonprofits Make. Even smart fundraisers can misstep when it comes to employer appending. This post highlights common errors and how to avoid them for better results.