Examples of Successful Payroll Giving Promotions from Nonprofits

Payroll giving is a powerful tool for nonprofits, enabling organizations to secure consistent funding while fostering a culture of philanthropy among employees. By implementing effective payroll giving promotions, nonprofits can significantly enhance their fundraising efforts. In this article, we will explore various successful payroll giving initiatives, providing insights and strategies that can help your organization maximize its impact.

- What is Payroll Giving?

- Understanding the Benefits of Payroll Giving

- 7 Successful Payroll Giving Examples

What is Payroll Giving?

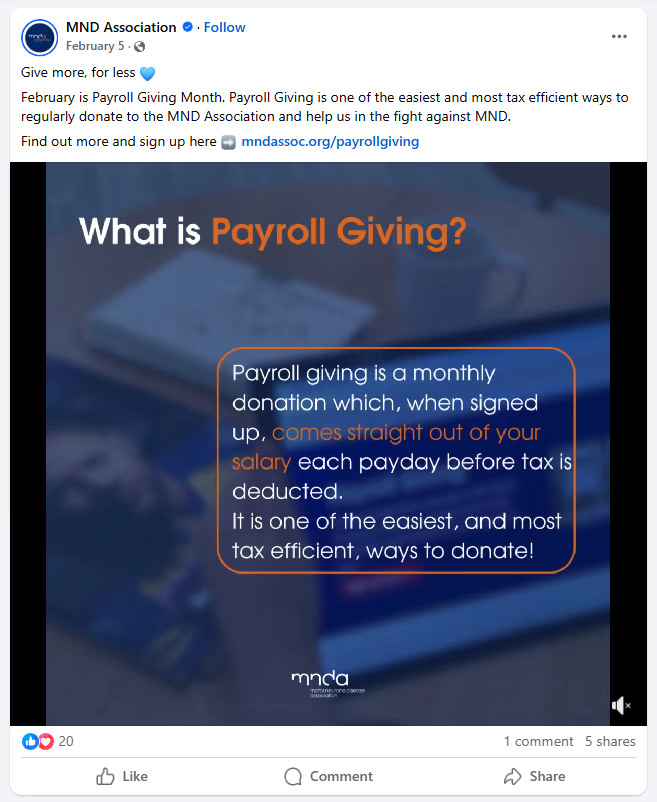

Payroll giving, also known as workplace giving, is a charitable donation program that allows employees to contribute a portion of their salary directly to a nonprofit organization. This method of giving is often facilitated through automatic deductions from employees’ paychecks, making it a convenient and efficient way for individuals to support causes they care about.

By participating in payroll giving, employees can make a significant impact without the need for large, one-time donations. This approach not only benefits the nonprofit organizations but also fosters a culture of giving within the workplace.

Benefits of Payroll Giving

7 Successful Payroll Giving Examples

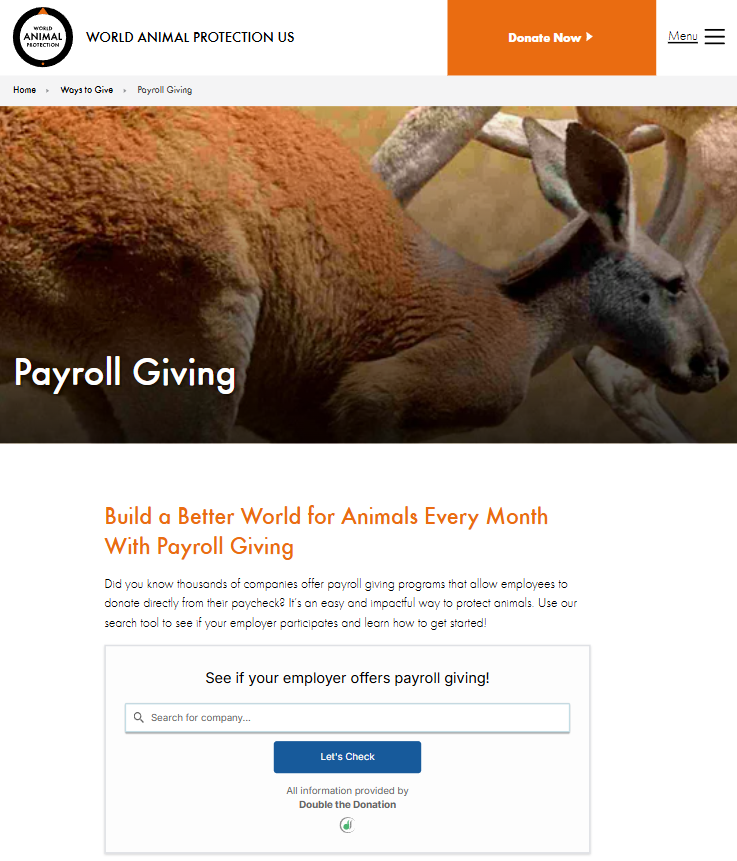

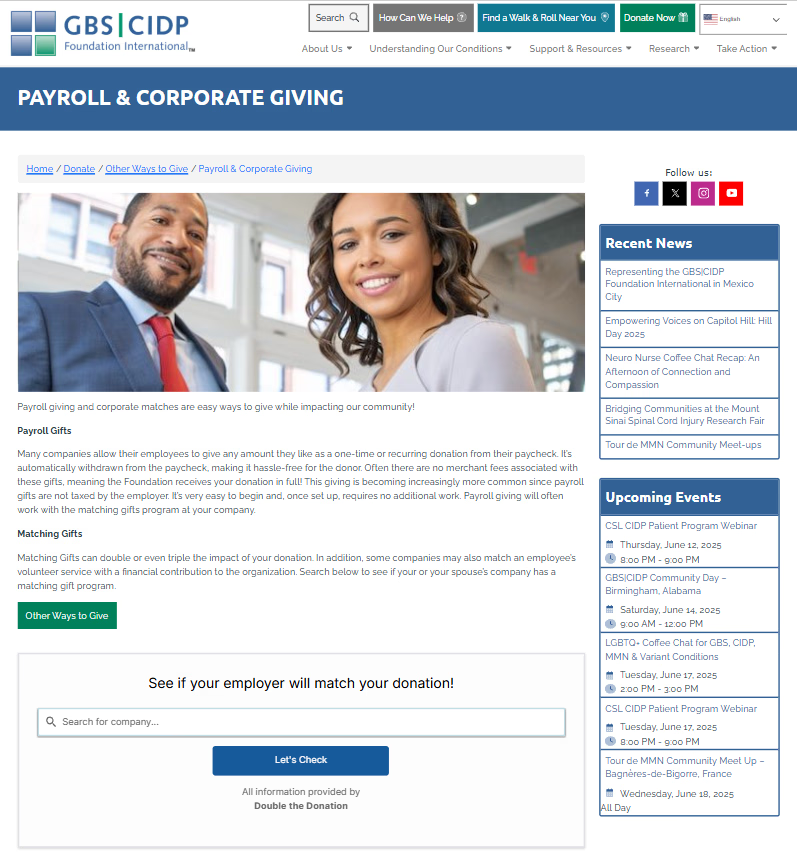

Many nonprofits have become adept at creating compelling marketing campaigns to encourage participation in payroll giving programs. By leveraging clear messaging, emotional appeals, and user-friendly tools, these organizations not only make giving easier but also deepen their connection with donors.

In this section, we’ll explore the strategies behind successful payroll giving campaigns from various nonprofits, highlighting what they do well and how their efforts make a meaningful impact.

Conclusion

Payroll giving is a valuable strategy for nonprofits looking to enhance their fundraising efforts and engage employees in meaningful ways. By implementing successful payroll giving promotions, organizations can secure consistent funding while fostering a culture of philanthropy within the workplace. From developing dedicated pages to leveraging social media and recognizing donors, these strategies can help nonprofits maximize the impact of their payroll giving programs.

As you explore these examples and strategies, consider how your organization can implement similar initiatives to drive engagement and support for your mission.

Explore Double the Donation’s Payroll Giving Tools

Ready to unlock the full potential of payroll giving for your nonprofit? Explore Double the Donation’s powerful payroll giving tools to easily identify eligible supporters and boost your fundraising efforts. Our platform helps you connect with the right donors, streamline the process, and raise more through workplace giving programs. Request a demo today and see the tools in action!