How to Increase Payroll Giving Donations at My Nonprofit

For many nonprofits, consistent funding is the key to long-term impact—and one of the most effective ways to secure that support is through payroll giving. If you’re looking to increase payroll giving donations at your organization, you’re not alone.

Payroll giving offers a unique opportunity to turn everyday supporters into reliable, recurring donors—often with minimal effort. But unlocking this potential requires more than just a checkbox on a form. In this post, we’ll walk you through practical strategies to boost participation, build stronger partnerships, and communicate the value of payroll giving in a way that inspires action.

We’ll cover the following expert-proven practices in order to do so:

- Understand payroll giving basics (and ensure your team does, too).

- Audit your current payroll giving efforts.

- Register with leading payroll giving platforms.

- Make it easy to get started with payroll giving.

- Clearly communicate the impact of the programs.

- Take a multi-channel marketing approach.

- Incentivize and recognize payroll giving donors.

- Monitor, evaluate, and optimize your strategy.

By implementing these strategies, your team can create a more compelling and accessible payroll giving program that drives sustained donor engagement. Whether you’re just getting started or looking to expand an existing effort, these tips will help you build a stronger foundation for long-term fundraising success.

1. Understand payroll giving basics (and ensure your team does, too).

Before you can effectively promote payroll giving, it’s essential that everyone on your team understands how it works—and why it matters. Payroll giving, a leading form of workplace or employee-led giving, allows companies’ staff to donate a portion of their salary to a registered charity directly through the company’s payroll system. These donations are typically deducted before tax, which makes giving easier and more cost-effective for donors.

For nonprofits, payroll giving can provide a stable and predictable stream of income while unlocking broader corporate partnership opportunities, too. But to take full advantage of this model, your staff and volunteers should be able to clearly explain the process, answer common questions, and articulate the unique benefits for donors.

Consider holding a short training session or creating a quick reference guide to get everyone on the same page. You can even use some of the free materials offered by Double the Donation to kickstart your education efforts!

When your team is confident in their understanding, they’ll be better equipped to engage potential donors, speak with corporate partners, and incorporate payroll giving into broader fundraising conversations. It’s a simple first step that lays the foundation for long-term growth.

2. Audit your current payroll giving efforts.

Before you invest time and resources to increase payroll giving donations at your organization, it’s important to understand where you currently stand. Conducting a simple audit will help you identify what’s working, where the gaps are, and what opportunities exist for improvement.

Start by gathering key data points such as these:

- How many donors are currently giving through payroll?

- Which employers are involved, and how active are those relationships?

- What percentage of overall donations comes from payroll giving?

- How are you promoting payroll giving (if at all) across your channels?

Look at your existing materials, too. Is the payroll giving option clearly explained on your website? Are sign-up forms easy to find? Are your staff and volunteers equipped to talk about it confidently?

This audit doesn’t have to be complex—but it should be honest. The goal is to create a clear picture of your current efforts so you can make smarter, more targeted decisions moving forward. Once you know what’s missing or underperforming, you can focus on the actions that will make the biggest impact.

3. Register with leading payroll giving platforms.

One of the most effective ways to increase payroll giving donations is to make sure your nonprofit is visible where it matters most—on the platforms employers and employees use to manage workplace giving. Many companies partner with third-party platforms to streamline payroll donations, and if your organization isn’t registered on them, you’re missing out on valuable exposure and potential supporters.

However, each platform has its own registration process, requirements, and fees, so take time to research and choose the ones that align best with your audience and mission. Registering typically involves providing your organization’s tax details, a mission statement, contact information, and banking information for receiving disbursements.

Once you’ve applied, you’ll want to make the most of your profile. Upload your logo, write a compelling summary of your work, and add impact stories or visuals where possible. A strong presence increases your chances of being selected by donors—and builds trust with corporate partners who rely on these platforms to vet nonprofits.

Being on the right platforms doesn’t just increase visibility—it simplifies giving, builds credibility, and helps your nonprofit tap into the networks of some of the world’s largest employers.

For direct links to top payroll giving platforms’ nonprofit applications, check out Double the Donation’s in-depth guide to the process.

4. Make it easy to get started with payroll giving.

Even the most generous supporters will opt not to complete their payroll giving enrollment if the process is too confusing or time-consuming. That’s why one of the most important steps you can take is to remove friction—and make signing up as easy as possible.

Start by creating a clear, dedicated page on your website that explains payroll giving and walks donors through how to get started. Use simple language, visuals, and a step-by-step guide to demystify the process.

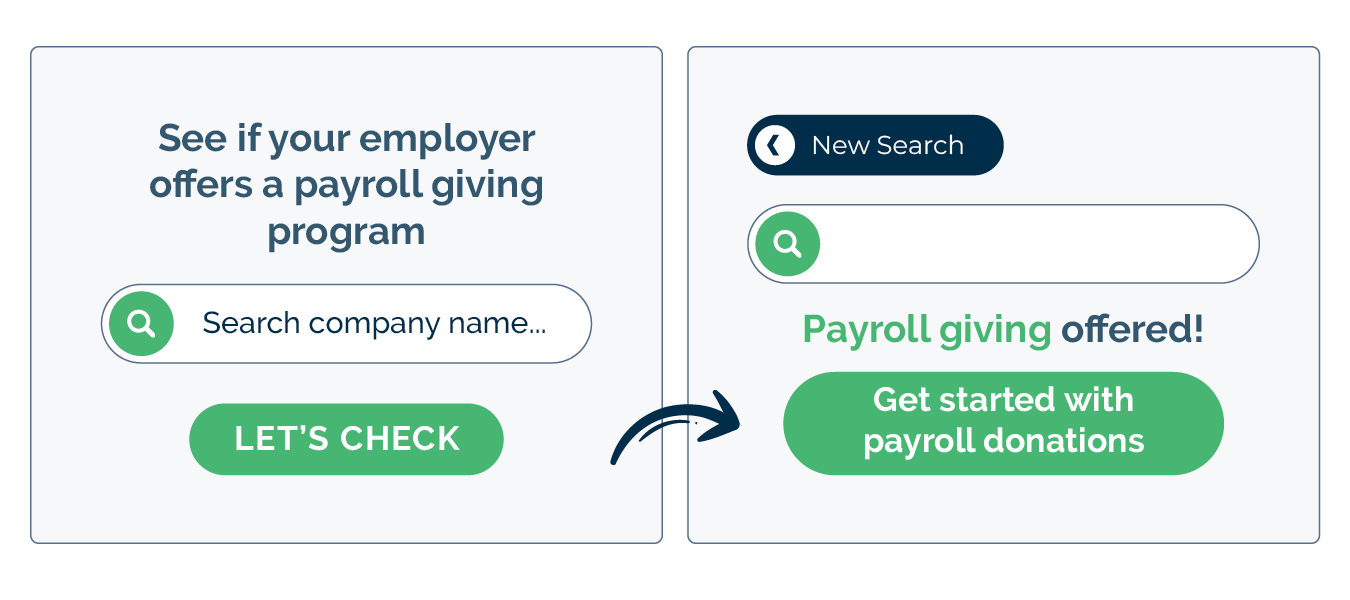

Better yet, incorporate tools that do the heavy lifting for you—like Double the Donation’s employer search tool. This tool allows supporters to enter their company name and instantly see if their employer offers a payroll giving (and/or matching gift) program. If eligible, they’ll receive direct links and instructions specific to their workplace, making the entire process streamlined and actionable.

Here’s how it helps:

- Instant eligibility check – No guesswork for donors

- Direct links to employer portals – Fewer abandoned attempts

- Simplified user experience – Higher conversion rates

By embedding this tool on your payroll giving page and linking to it in email campaigns, donation confirmations, and social posts, too, you empower donors to act immediately. The easier you make it, the more likely they are to follow through—and the faster your program will grow.

5. Clearly communicate the impact of the programs.

People are far more likely to give—and keep giving—when they understand the real-world impact of their donations. Payroll giving can sometimes feel abstract or automatic, so it’s your job to make the results tangible, personal, and inspiring.

To do so, try demonstrating to your supporters exactly how their recurring contributions are making a difference. Instead of saying, “Your donation helps us do more,” get specific with it. Here are a few examples:

- “A $20 monthly payroll gift provides clean water to one family every month.”

- “Ten employees giving $10 each can fund a week of after-school programs for 30 students.”

- “Just $5 a month via payroll giving allows our team to feed a rescued animal, giving them the nourishment they need while they wait for a forever home.”

For the best results, use a combination of storytelling and hard data to bring your impact to life. Share beneficiary stories, before-and-after photos, short videos, and statistics that highlight what payroll gifts make possible. Testimonials from current payroll givers can also be powerful—especially when they come from peers within the same companies.

Don’t forget to close the loop regularly, too. Send updates, thank-you messages, and annual impact reports to both individual donors and partner companies. When people can clearly see the change they’re helping create, they’re more likely to stay engaged—and to encourage others to join them.

6. Take a multi-channel marketing approach.

To truly grow your payroll giving program, it’s not enough to mention the opportunity once or bury it in a newsletter footer. For the best results, you need to promote it consistently across a range of avenues. In other words, a multi-channel payroll giving marketing strategy ensures you reach donors wherever they are, reinforcing the message and making it easier for them to take action.

Here are a few ways to promote payroll giving across key channels:

- Your Website: Dedicate a clear, easy-to-find page to payroll giving. Include an overview, impact examples, and resources like Double the Donation’s search widget to help donors get started.

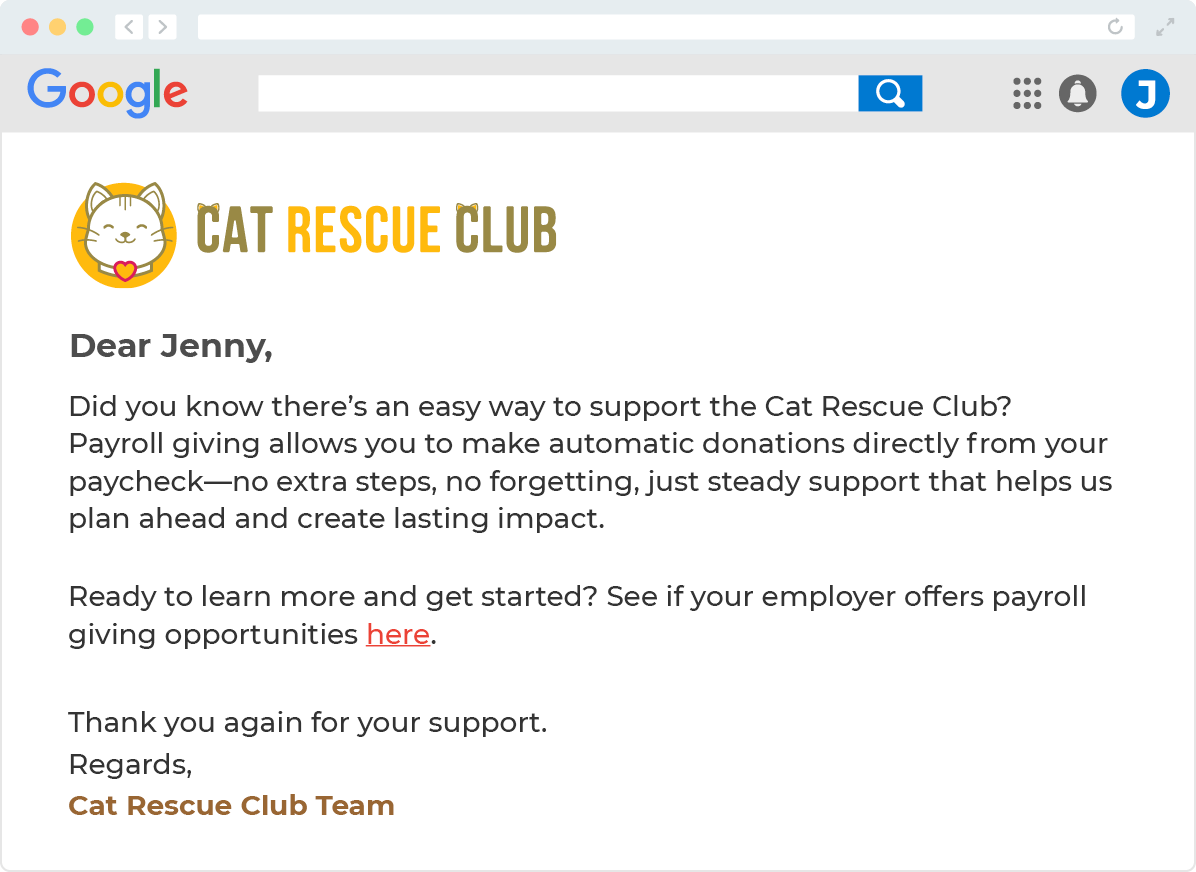

- Email Campaigns: Create targeted emails that explain how payroll giving works and share stories of current donors. Use clear calls-to-action and link directly to sign-up instructions.

- Social Media: Post regular content highlighting payroll giving success stories, impact stats, and testimonials. Short videos and infographics can help simplify complex information, too.

- Events: Whether virtual or in-person, use events as an opportunity to introduce payroll giving as a simple, long-term way to support your mission.

- Printed Materials: Include payroll giving information in brochures, direct mail appeals, donor welcome packets, and more.

The key? Consistency.

By showing up across different touchpoints with a clear and unified message, you increase awareness, remove friction, and create multiple opportunities for donors to take that next step. Over time, this kind of visibility builds both momentum and participation to ultimately increase payroll giving donations at your nonprofit.

7. Incentivize and recognize payroll giving donors.

Donors who commit to giving through payroll are doing something special—they’re pledging ongoing support that sustains your mission month after month. Recognizing and rewarding that commitment not only shows appreciation but also helps encourage more people to get involved.

Here are a few ways to start with simple, meaningful recognition:

- Send a personalized thank-you message as soon as someone enrolls.

- Create a welcome email series for new payroll donors that includes updates, behind-the-scenes insights, or stories from the field.

- Highlight donors in your newsletter, website, or social media (with their permission) to show appreciation and build community.

You can also introduce low-cost incentives to boost participation, such as:

You can also introduce low-cost incentives to boost participation, such as:

- Exclusive swag (stickers, bags, t-shirts, or digital badges) for payroll givers

- Early access to events or content

- A monthly “Payroll Giving Champion” spotlight for standout supporters

Ultimately, when donors feel seen, valued, and connected to your mission, they’re more likely to stick around—and to encourage others to join them. A little recognition goes a long way in building a strong, loyal base of payroll supporters.

8. Monitor, evaluate, and optimize your strategy.

Even the most well-planned payroll giving campaign needs regular check-ins to stay effective. Once your program is up and running, make it a priority to track its performance, evaluate what’s working (and what’s not), and make data-informed improvements over time.

For example, if one company consistently drives strong participation, dig into what’s working there and look for ways to replicate that success elsewhere. If another campaign underperforms, look closely at your messaging, timing, or promotional channels to identify gaps.

Collect qualitative feedback, too. Ask current payroll donors why they give—and what might improve their experience. Reach out to corporate partners to understand how the process is working on their end and if their employees are engaging with your materials.

Lastly, treat your strategy as a living, evolving plan. As donor behavior shifts and new tools become available, be ready to adapt. Testing small changes—like email subject lines, impact messaging, or campaign timing—can lead to big results over time.

Wrapping up & additional payroll giving resources

Payroll giving is more than a donation method—it’s a pathway to deeper donor engagement and long-term sustainability for your nonprofit. By making it easy, impactful, and rewarding, you can grow your payroll giving program into a dependable revenue stream that supports your mission year-round.

Start by assessing your current efforts, strengthen your prospective donor relationships, and don’t underestimate the power of clear communication and gratitude. With the right approach, you can confidently increase payroll giving donations and build a loyal base of workplace donors who champion your cause every pay cycle. Good luck!

Ready to learn even more about payroll giving practices for nonprofit success? Check out these additional recommended resources:

- Companies With Payroll Giving: Top Employers You Should Know. Discover a list of major companies that actively support payroll giving programs. Learn who they are, what they offer, and how your nonprofit can partner with them to tap into steady, recurring donations.

- How to Register Your Nonprofit for Payroll Giving [6 Steps]. A step-by-step guide to getting your organization set up on payroll giving platforms. From choosing the right providers to submitting your application, this resource makes the registration process simple and stress-free.

- Top 10 Strategies For Marketing Payroll Giving to My Donors. Unlock the most effective marketing tactics to promote payroll giving. This guide covers messaging tips, campaign ideas, and proven ways to raise awareness and boost participation across all your channels.