Top 10 Strategies For Marketing Payroll Giving to My Donors

In today’s competitive nonprofit landscape, securing sustainable and reliable funding sources is more crucial than ever. One powerful yet often underutilized tool in your fundraising toolkit is marketing payroll giving—or the practice of promoting workplace giving programs that allow employees to donate directly from their paychecks. This method of giving offers donors a convenient, tax-efficient way to support causes they care about, while providing nonprofits with consistent, long-term support.

But simply offering payroll giving isn’t enough—promoting it effectively to your donors is key. In this post, we’ll explore the top ten strategies for successfully marketing payroll giving, helping you boost participation, deepen donor engagement, and secure long-term impact for your cause. These include:

- Telling impact stories.

- Creating a dedicated payroll giving page.

- Targeting the right audiences.

- Organizing dedicated workplace giving campaigns.

- Highlighting tax benefits.

- Leveraging matching gift opportunities.

- Enlisting multi-channel marketing.

- Personalizing your asks.

- Establishing a sense of community.

- Following up and saying thank you.

With the right approach, these leading strategies can turn payroll giving from an overlooked option into a cornerstone of your fundraising success. Whether you’re just launching a program or looking to boost existing participation, these proven tactics will help you connect with donors more effectively, build lasting relationships, and ensure your mission stays funded—paycheck by paycheck.

1. Tell impact stories.

One of the most powerful ways to market payroll giving is by showing donors exactly how their contributions make a difference. In other words, impact stories turn abstract donations into tangible outcomes, helping supporters see the real-world results of their generosity. This emotional connection not only builds trust but also encourages ongoing participation in payroll giving programs.

When crafting impact stories, focus on the individuals or communities your organization has helped—ideally, those directly supported by payroll donations. Share real names (with permission), quotes, and photos to bring these stories to life. Whether it’s a child who received access to education, a family given emergency shelter, or an endangered species protected thanks to regular contributions, these narratives help donors understand the value of consistent support.

Remember, people are more likely to give—and keep giving—when they feel their support matters. Telling clear, authentic impact stories is one of the most effective ways to make payroll giving feel personal, meaningful, and rewarding.

2. Create a dedicated payroll giving page.

To boost participation in payroll giving, it’s crucial to make the process as simple and intuitive as possible. After all, a streamlined experience removes barriers and encourages more supporters to take action.

Start by building a dedicated payroll giving page on your website. This central hub should clearly explain what payroll giving is, why it matters, and—most importantly—how supporters can get started. Include step-by-step instructions, FAQs, and, if possible, visual aids like short videos or graphics to walk donors through the setup process.

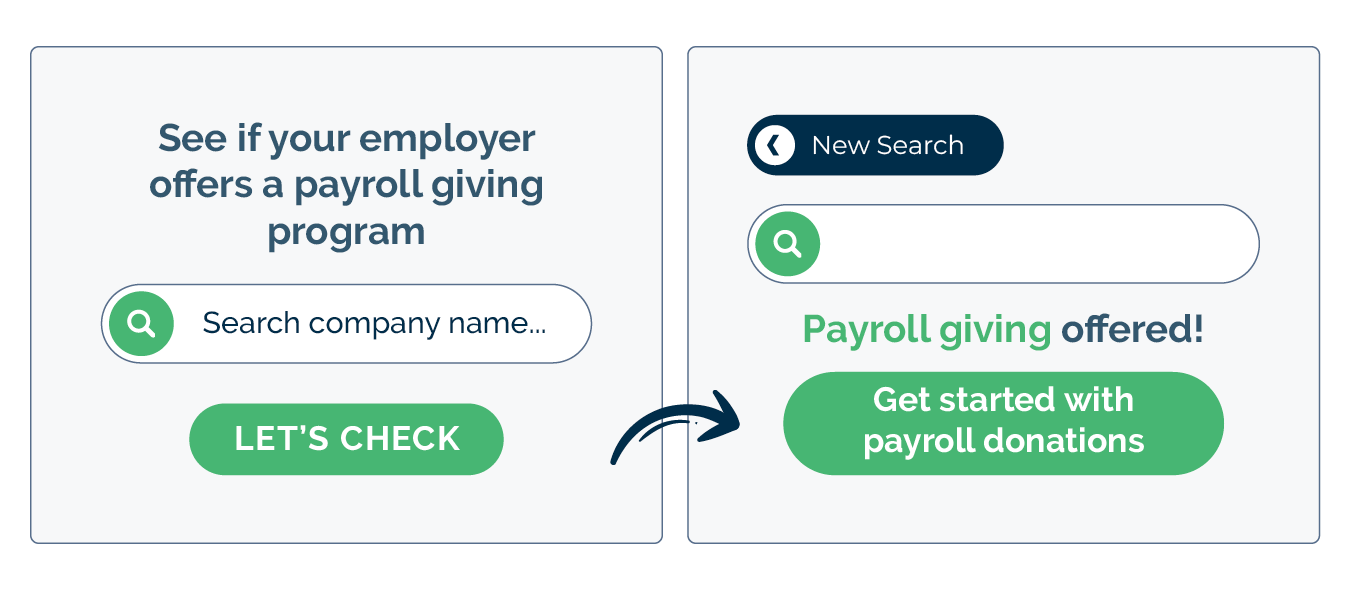

One of the most impactful features you can embed on this page is Double the Donation’s workplace giving database. This tool allows donors to search for their employer and instantly find out if payroll giving is offered, how to enroll, and whether their donations qualify for matching gifts. By embedding the database directly into your payroll giving page, you remove guesswork and guide supporters through the process—all in one place.

The bottom line is this: The easier it is for donors to understand and act, the more likely they are to sign up and stay engaged over time. Simplifying the experience through a well-designed page with an embedded tool is a powerful way to drive results.

3. Target the right audiences.

Not all donors are equally positioned to participate in payroll giving; therefore, identifying and targeting the right audiences is crucial to maximizing your success. By focusing your efforts on those most likely (and eligible) to engage, you can use your time and resources more efficiently and drive better results.

Start by segmenting your donor base. Look for individuals who work at mid-to-large-sized companies, especially those known to offer workplace giving programs. Younger professionals, corporate employees, and those who already give monthly are often ideal candidates. Use email segmentation, surveys, or employer information (if available) to tailor your outreach accordingly.

You can also collaborate with corporate partners or companies that support your cause. Ask them to help promote payroll giving internally—through HR communications, intranet posts, or virtual events. These “warm” audiences are already connected to your nonprofit and may be more receptive to signing up when the opportunity is promoted in their work environment.

Don’t forget to craft messaging that speaks directly to each group’s values and motivations. For example, emphasize convenience and impact for busy professionals, or highlight tax benefits for financially savvy donors. The more targeted and relevant your message, the more effective it will be.

By honing in on the right audiences, you’ll reduce outreach fatigue, increase conversions, and build a stronger, more engaged payroll giving community.

4. Organize dedicated workplace giving campaigns.

To truly elevate awareness and participation in payroll giving, consider running dedicated workplace giving campaigns throughout the year. These focused efforts allow you to spotlight payroll giving (and other programs, such as matching gifts and volunteer grants) as a unique and impactful way to support your cause, rather than just one of many giving options buried in broader fundraising messages.

A dedicated campaign can be as simple or robust as your resources allow. Start by choosing strategic times to launch, such as during year-end giving, the back-to-school season, Payroll Giving month (which occurs in February each year), or in alignment with national awareness days relevant to your mission. Then, develop cohesive messaging that highlights the convenience and long-term benefits of payroll giving.

Incentives can boost participation, too. Consider offering exclusive thank-you gifts, social media or other online shout-outs, or even a friendly competition between departments to see who can get the most employees signed up.

By carving out space in your calendar for dedicated payroll giving campaigns, you create momentum, build awareness, and give donors a clear and timely reason to take action—all while strengthening relationships with supportive employers.

5. Highlight tax benefits.

One of the most compelling advantages of payroll giving is its built-in tax efficiency. However, many donors aren’t fully aware of how it works. By clearly communicating the tax benefits, you can alleviate uncertainty and provide supporters with an additional incentive to enroll.

Here’s how it works: With payroll giving, donations are often deducted from an employee’s salary before tax is applied. This means the donor receives immediate tax relief without needing to keep receipts or wait until the end of the year to claim deductions. It’s a streamlined, “set-it-and-forget-it” way to give—and save—at the same time.

When promoting payroll giving, include clear examples of how much a donor’s gift actually costs them after tax. For instance: “A $10 monthly donation may only cost you $8, depending on your tax bracket.” These simple illustrations help make the benefit tangible and easier to understand.

You can also include this information on your donation pages, email campaigns, and workplace giving materials. If your organization operates internationally or across regions, be sure to tailor the tax information to the donor’s local context or direct them to where they can learn more.

By shining a spotlight on the tax perks of payroll giving, you remove a potential barrier and provide donors with a practical reason to choose this method over others. It’s a win-win for them and for your mission.

6. Leverage matching gift opportunities.

Corporate matching gifts can be a game-changer for payroll giving, doubling—or even tripling—the impact of every donation. And many companies offer both types of giving programs, too. Yet many donors aren’t aware their employer offers this benefit, or how easy it is to take advantage of it.

By proactively promoting matching gift opportunities, you can encourage more donors to enroll in payroll giving and maximize their contributions accordingly.

Start by identifying companies that offer payroll donation matching. Tons of employers have established corporate giving programs that match employee donations dollar for dollar, especially when made through payroll. If you have access to donor employment data, segment your communications to highlight matching options for eligible supporters.

Again, one of the most effective tools you can use is Double the Donation’s matching gift search tool, which allows donors to quickly check if their employer offers a match and learn how to submit the request. You can embed this tool on your payroll giving page (and your matching gifts page) or link to it in your email campaigns to make the process even smoother.

7. Enlist multi-channel marketing.

To effectively promote payroll giving, you need to meet your supporters where they are—and that means using a variety of communication channels. After all, a multi-channel approach to marketing payroll giving ensures your message is seen, heard, and remembered.

For a well-rounded strategy, we recommend incorporating the following channels:

- Your nonprofit website: Establish a dedicated payroll giving page that explains the benefits, provides clear instructions, and includes tools like Double the Donation to help supporters check their eligibility and get started. Make this page easy to find—link to it from your homepage, donation forms, and campaign banners so that supporters can learn more.

- Email marketing: Next, use email marketing to target your existing supporters. Segment your list by donor type, employer (if known), or giving history to send personalized messages that highlight payroll giving as a convenient and impactful way to contribute. Include clear calls to action, helpful FAQs, and links to your sign-up page.

- Social media: Create bite-sized content that promotes payroll giving in a visually engaging way. Use graphics, quotes, impact stats, and short videos to tell stories and explain how payroll donations work. Don’t forget to tag corporate partners and encourage them to reshare your posts to reach their employees.

Regardless of the platform(s) you choose, it’s important to remember that consistency is key. Repetition across platforms reinforces the message and increases the chance that donors will take action.

By enlisting multi-channel marketing, you’ll dramatically increase visibility for your payroll giving program and make it easier for donors to engage, no matter how or where they connect with your organization.

8. Personalize your asks.

Personalization is one of the most effective ways to drive engagement, and that holds true for payroll giving. Rather than sending generic appeals, tailor your messages to reflect each donor’s relationship with your organization, their giving habits, and their potential eligibility for workplace giving programs. A well-targeted ask feels more relevant, more thoughtful, and more compelling.

Start by using the donor data you already have. If you know where a donor works, mention their employer’s payroll giving program directly and highlight any matching gift opportunities they may be eligible for. If they’ve given monthly in the past, explain how payroll giving offers the same consistency, with added convenience and tax benefits.

You can also personalize your messages based on giving history or interests. For example: “As someone who’s supported our education programs, payroll giving is a powerful way to help even more students every month—automatically, right from your paycheck.”

By personalizing your asks, you show donors that they’re not just one of many. Instead, you see them, appreciate them, and are offering a way to make their giving even more meaningful.

9. Establish a sense of community.

Payroll giving is more than just a transaction. To keep donors engaged and inspired, it’s important to foster a sense of community among those who support your cause through their paychecks. When donors feel like they’re part of something bigger, they’re more likely to stay involved and even encourage others to do so as well.

One way to build this community is by creating recognition and connection points specifically for payroll givers. For example, consider giving them a name, like “Monthly Impact Partners” or “Team Change-Makers,” and referencing it across your broader communications. This helps donors feel seen and included in a collective effort.

Encouraging peer advocacy is another powerful tool. Invite existing payroll donors to share why they give at work and encourage their colleagues to join. This type of social proof builds credibility and reinforces the sense of shared purpose.

10. Follow up and say thank you.

A simple “thank you” can go a long way, especially when it comes to marketing payroll giving. Donors who give through their paycheck often do so quietly and consistently, without the fanfare often associated with a one-time donation. That makes follow-up and appreciation even more important. Recognizing their ongoing support not only shows gratitude but also reinforces the impact of their commitment.

Start by acknowledging payroll donors as soon as they enroll with a personalized thank-you email or message. Let them know their recurring support is valued and explain how it contributes to your mission over time. If possible, include specific examples of what their monthly gift makes possible.

But don’t stop there. Schedule periodic follow-ups—whether quarterly or annually—to share updates, impact stories, and outcomes that their donations have helped achieve. These updates help donors feel connected and remind them why their ongoing support is essential.

Consider sending a special thank-you at key milestones, too, like their one-year anniversary or during the holiday season. This could be a handwritten note, a small token of appreciation, or even a digital badge they can display proudly at work or online.

By following up regularly and saying thank you with sincerity, you strengthen the relationship between your organization and your payroll donors. And when donors feel appreciated, they’re not only more likely to keep giving—they’re more likely to become advocates for your cause.

Wrapping Up & Additional Resources

Payroll giving holds incredible potential for nonprofits seeking consistent and scalable donor support. And with the right marketing strategies and the tools to back it, you can turn this quiet giving method into a cornerstone of your fundraising efforts.

Interested in learning more about payroll giving opportunities? Check out these additional recommended resources:

- Companies With Payroll Giving: Top Employers You Should Know. Discover which major companies are leading the way in payroll giving. This post highlights top employers that actively support workplace giving programs—perfect for identifying partnership opportunities.

- Tracking Payroll Giving: A Nonprofit’s Step-by-Step Guide. Managing payroll giving doesn’t have to be complex. This step-by-step guide walks nonprofits through the process of tracking donations, managing donor data, and ensuring transparency—all essential for maximizing impact.

- Payroll Giving Statistics | 13 Fun Facts for Fundraisers. Want to inspire your team or spark interest in your next campaign? These 13 eye-opening payroll giving statistics offer insightful data points that can help you tell a compelling story and motivate both donors and partners alike.