How to Secure Corporate Partnerships for Your Nonprofit

It’s easier to fulfill your mission when you have multiple organizations supporting you. Giving USA reported that in 2023 alone, corporations donated $36.55 billion to nonprofits, and if your nonprofit secures a corporate partnership, some of that money could go to your cause!

To help your nonprofit earn corporate partnerships, this guide will explore:

- What are Corporate Partnerships?

- Types of Corporate Partnerships

- Corporate Partnership Benefits

- How to Find Corporate Partnership Opportunities

- How to Earn Corporate Partnerships

- What to do After Earning a Corporate Partnership

First, let’s review exactly what corporate partnerships are and how they differ from other corporate philanthropy programs.

What are Corporate Partnerships?

Corporate partnerships are a type of corporate giving where a business and a nonprofit collaborate to benefit both organizations. Partnerships agreements vary widely in terms of what type of support business provide and what your nonprofit is expected to give in return.

For nonprofits forming partnerships with local businesses, these agreements are more likely to be tailored to fit your nonprofit’s and the business’s specific needs. In contrast, corporate giving programs like matching gifts usually have the same standards for all nonprofits.

Types of Corporate Partnerships

Corporations and nonprofits can work together in all sorts of ways, including:

- Monetary sponsorships. Financial donations are likely what first comes to mind when you hear the word “sponsorship.” However, even these can vary. For instance, a business might provide a one-time lump sum donation, whereas another could provide donations on a recurring basis. One unique type of monetary sponsorship is a matching gift challenge in which a business agrees to match all donations your nonprofit earns during a set period of time. For example, a business might agree to match your GivingTuesday earnings.

- In-kind donations. Goods and services can also be donated through corporate partnerships. These are especially useful for certain types of initiatives and fundraisers. For example, if your nonprofit plans to host a silent auction, you would primarily seek in-kind donations in the form of auction prizes.

- Marketing. Cause marketing generally takes two forms: the nonprofit and business collaborate to promote the nonprofit’s mission, or the business organizes a marketing campaign independently. Usually, cause marketing involves a business promoting its products with the promise that a portion of proceeds will go to its nonprofit partners.

- Employee-oriented efforts. To provide ongoing support, a business might set up an employee giving program so their team can easily support your nonprofit. For example, they might add your nonprofit to the list of charitable organizations employees can give to through automatic payroll deductions, or they could start a matching gift program to support a variety of nonprofits, including your organization.

- Co-branded initiatives. Nonprofits and businesses can work together to launch products, services, events, and marketing campaigns. For example, a business might launch a product line where a portion of sales are donated to your cause.

The exact details of your partnership agreement will depend on your needs and the business’s interests. In some cases, you might have arrangements that involve multiple types of support, such as a business providing a monetary donation for an event and agreeing to promote it to their customers. In exchange, your nonprofit would promote the business at the event and highlight its contributions.

Corporate Partnership Benefits

When businesses partner with nonprofits, they get to show off their dedication to social good and positive corporate citizenship to customers and employees alike. This results in boosts in sales, employee retention, and generally positive press.

For nonprofits, corporate partnerships also bring a number of benefits, including:

- Financial support. Quite plainly, nonprofits need funding to operate, and corporate corporations can be valuable contributors. Plus, if you establish a positive relationship with a business, you may receive reliable ongoing support for years to come through future partnership deals.

- Access to services and products. In-kind donations can provide your nonprofit with exclusive products and services you might otherwise have to factor into your budget. For instance, you might get discounts on renting a venue space for an event, skilled graphic designers to create your marketing materials, or new computers for your entire office.

- Increased visibility. Corporations agree to partner with nonprofits as a business decision, knowing they can receive a positive reputation boost from publicizing the arrangement. As such, many partnerships involve promoting your cause to their employees and customers, putting your organization in front of new prospective supporters.

Ultimately, corporate partnerships are a win for your nonprofit and businesses. You receive the support you need to fulfill your mission and businesses get the marketing boost they need to promote their offerings.

How to Find Corporate Partnership Opportunities

Often, the hardest part of securing a corporate partnership is making initial contact. After all, not every business is interested in partnering with nonprofits, and of those that are, many only want to work with specific types of nonprofits.

So how can a nonprofit find prospective business partners? A few ways include:

- Exploring your network. To get your foot in the door, assess your network for potential business connections. For example, your board likely consists of active members of your community. Ask them to reach out to business leaders they know to set up introductions. Additionally, analyze your donor base for corporate connections. If many of your donors work for the same employer, they might be willing to put you in touch with a business’s point of contact for partnership deals.

- Starting local. Your nonprofit serves your community, and local businesses sell to your local community. These companies see your impact and are likely to partner with charitable organizations that directly serve their customers.

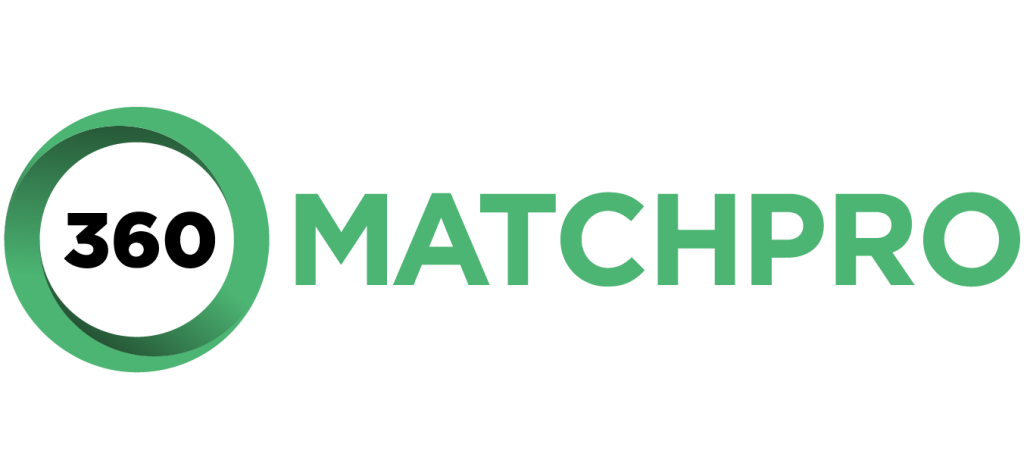

- Using prospect research tools. Tools like corporate giving databases can provide information on businesses’ ongoing philanthropic initiatives. For example, by inputting a business’s name into a tool like Double the Donation, you can identify their matching gift and volunteer grant opportunities.

Additionally, some businesses interested in partnering with nonprofits might seek out your organization. Ensure you are easy to find by making your website user-friendly and considering corporations as a user audience.

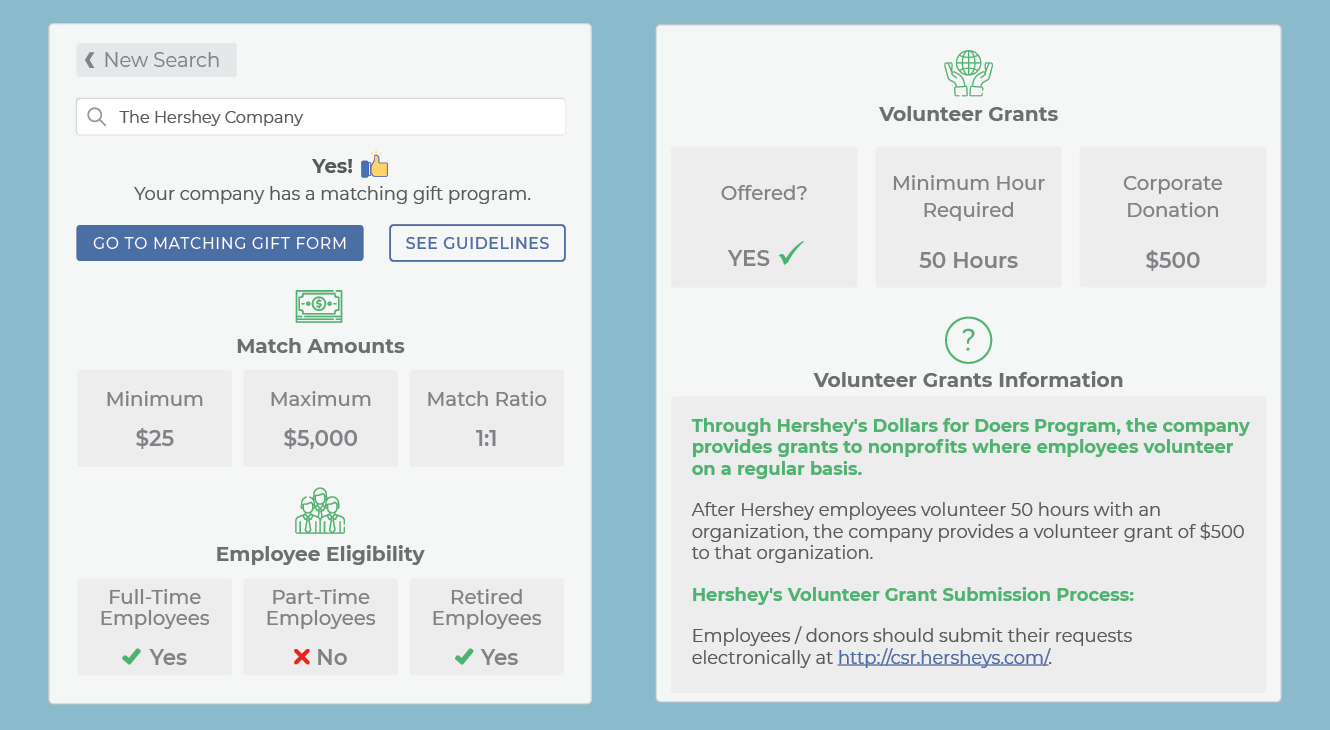

Many nonprofits have pages specifically dedicated to promoting their partnership opportunities to manage inbound deals. For example, the ASPCA calls their corporate partners Business Ambassadors and has an informational page about becoming one:

How to Earn Corporate Partnerships

Research prospects.

When conducting prospect research on individual donors, nonprofits look for two things: the capacity and affinity to make a major donation. These are estimates of how much a donor is able to give and how likely they are to make a major contribution.

These same principles apply to corporate partners. You can assess whether a business has the ability and desire to support a nonprofit like yours by researching its:

- Philanthropic mission. Companies that regularly engage in philanthropic activities usually have a stated mission and are more likely to support nonprofits with causes that align with that mission. Sometimes these missions are a concise statement, whereas other businesses have entire pages on their websites dedicated to explaining their values. For example, check out Ben & Jerry’s Values, Activism, and Mission page explaining their commitment to social justice.

- Giving history. Research what nonprofits a business has partnered with in the past. This can give you an idea about the types of causes and organizations they’re interested in supporting. Additionally, a business with a long history of working with nonprofits is far more likely to continue agreeing to partnerships than a business that has yet to engage in philanthropy.

- Giving capacity. Before pitching partnership deals, consider how a business will likely be willing to support your nonprofit. For example, you can estimate their ability for monetary donations by examining a few factors. First, when exploring a business’s philanthropic history, look for how much was donated or what level of support was offered. Businesses often report these figures themselves, and you may be able to find details in the recipient nonprofit’s Form 990s. Also, assess how well the business is currently doing financially. A growing business reporting high profits is far more likely to experiment with a new sponsorship arrangement or nonprofit marketing co-venture than one that’s struggling.

Take detailed notes about each business you plan to approach. Create a list of prospects and sort them by how likely they are to support your nonprofit and how valuable that support would be.

Introduce your nonprofit.

You might be eager to start meeting with prospective business partners and making your pitch right away, but you should start your relationship off strong by properly introducing your nonprofit.

This initial introduction should include that your nonprofit is interested in forming a partnership with the business, but this is not the time to immediately dive into negotiations. Instead, craft a partnership proposal, such as a sponsorship letter, that explains what your nonprofit does, what projects you seek funding for, and why you feel the business would be a good partner for your nonprofit.

The specific elements your partnership proposal should include are:

- Executive Summary

- Needs/Opportunities

- Goals

- Business Benefits

- Budget and Finances

- Timeline

As you cultivate relationships with prospective business partners, create profiles for them in your CRM to track interactions and determine when the right time is to make your pitch.

Tailor your pitch.

You may have heard the term “case for support” before, which is an explanation of why donors should support your nonprofit.

When pitching to businesses, many of the principles still apply. However, for donors, a case for support usually includes the unstated benefit that donors feel good about themselves and the impact their contributions make.

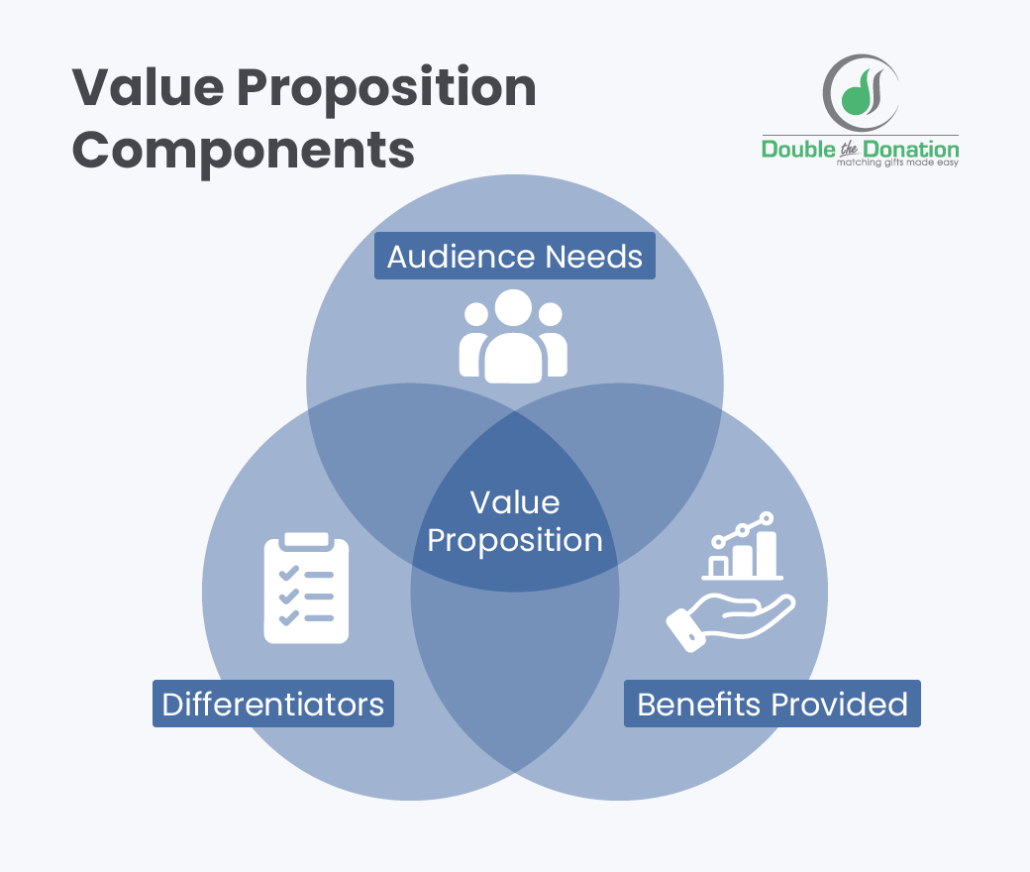

In your partnership pitch, you will need to provide explicit benefits and explain why exactly those benefits matter to the business you’re addressing. As such, consider your corporate partnership value proposition. A value proposition consists of the following elements:

- Audience needs. Consider why a specific business would want to partner with your nonprofit. This might be to improve their reputation, expand their audience, or earn a tax break.

- Differentiators. This is a prime opportunity to explain why promoting the business to your nonprofit’s audience will be beneficial. For instance, you might discuss how a business’s customer base and your nonprofit’s supporters share the same values, demographics, or buying power.

- Benefits provided. Lay out exactly what your nonprofit will provide the business in exchange for their support.

Put together, your nonprofit might create a pitch that explains how your supporter base has a high percentage of families, and if a local family restaurant agrees to reduced catering fees for an event, they can provide samples to those families, marketing their food and securing future customers.

Your value proposition will differ in your pitch for each business based on that prospective corporate partner’s unique product offerings, customer base, and goals.

Be open to negotiating.

While your pitch may be strong, the businesses you approach will likely have their own ideas about what they want a nonprofit collaboration to look like.

For instance, you might approach a business asking for a one-time monetary sponsorship, which they decline but offer an ongoing cause marketing agreement instead. Be open to these situations and ready to hammer out custom deals.

If your pitch team does not have an immediate answer to whether a new proposed deal is acceptable, be gracious to the corporate partner for their offer, share that you need to consult other members of your team, and if possible, provide a timeline for getting back to them with an answer.

Even if your proposal gets rejected, you decline a partnership offer, or the opportunity falls through, remember to thank businesses for their time and consideration. While they may not be able to support you now, they’re more likely to work with a nonprofit whose team they had a positive experience with in the future.

Get confirmation in writing.

Your partnership agreement should include all details about how and when your nonprofit and the business will collaborate. For instance, this might include when a business is expected to send out team members to offer pro-bono services and how long they will work for your nonprofit.

While verbal commitments are useful during negotiations and confirming details, documenting your partnership deal in writing ensures that both your nonprofit and the corporation know exactly what is being agreed upon and can refer back to the agreement later.

Remember that corporate partnerships are often legally binding contracts, and your nonprofit’s lawyers should review all materials before signing anything.

What to do After Earning a Corporate Partnership

Earning a sponsorship feels great! Your nonprofit has secured vital support for fulfilling your mission. However, there are still a few responsibilities your nonprofit needs to take care of at this stage. These include:

- Fulfilling your obligations. To maintain a positive relationship with your sponsors and uphold your end of the sponsorship contract, your nonprofit needs to complete whatever obligations you agreed to. This might involve ongoing promotion, so be sure to keep your marketing team in the loop about what’s expected of them.

- Reporting added income properly. Some partnerships will include monetary support for your nonprofit and need to be properly reported on your taxes. A sponsorship can either be considered a tax-free gift or a taxable unrelated business income. To ensure your sponsorships are treated as the former, the business must not receive what the IRS deems a “substantial return benefit” for the sponsorship. A few factors that the IRS considers make a sponsorship substantial—and thus taxable—include being an exclusive sponsor, linking to the sponsor’s product pages, providing more than token privileges to the sponsor, and providing free advertising in materials that normally require payment. This list is not exhaustive, and in general, nonprofits can ensure sponsorships are seen as gifts by displaying a sponsor’s name or logo but not actively endorsing their products or services.

- Thanking the corporate partner. After receiving a donation, your nonprofit thanks supporters to establish a positive relationship and encourage future gifts. The same principles apply to your corporate partners. Reach out to your partners to thank them for their contributions. These thank-yous should be more substantial than a quick email, such as calling them on the phone or sending a thoughtful letter in the mail.

By following proper protocol after forming a corporate sponsorship, your nonprofit will increase its credibility and trustworthiness. This can lead to future partnerships with the same business, and when approaching other businesses, you can share details about past successful partnerships to improve buy-in.

More Corporate Giving Resources

Corporate partnerships provide your nonprofit with the additional resources you need to host events, launch new initiatives, and spread awareness of your cause far and wide. To secure these opportunities, ensure your pitch is focused, prepared, and tailored to your audience.

For more resources on corporate opportunities for nonprofits, check out these resources:

- How to Secure Corporate Sponsorships: Find Your Perfect Fit. Looking for more information about corporate sponsorships? Check out this guide to finding the perfect sponsors for your nonprofit.

- Securing Corporate Sponsorships: How to Lock Down Support. Learn more about securing corporate sponsors, especially how to connect with Google and access their Google Ad Grant program.

- Corporate Giving Programs: The Ultimate Social Impact Guide. Discover more types of corporate giving programs to complement your business partnerships!