Corporate Giving Programs: The Ultimate Social Impact Guide

Corporate giving programs are a structured way for businesses to give back to their community by financially supporting nonprofits. This empowers nonprofits to secure corporate support conveniently and can lead to mutually beneficial relationships between businesses and nonprofits.

Whether you’re a business owner or a nonprofit professional, knowing all about corporate giving programs will set you up to create or leverage valuable programs that help the community. Specifically, we’ll cover the following topics:

- What Is Corporate Giving?

- What Are the Benefits of Corporate Giving Programs?

- Types of Corporate Giving Programs

- How to Start a Corporate Giving Program

- Software for Corporate Giving Programs

Let’s start by learning what corporate giving is and why it’s important.

What Is Corporate Giving?

Corporate giving falls under the umbrella of corporate social responsibility (CSR) as a way for businesses to invest in their local communities. Corporate giving programs are specifically designed to facilitate charitable giving to nonprofits, defining the process and setting guidelines to make giving more convenient.

Usually, corporate giving is driven by a business’s employees. The more the employees donate their money or volunteer time to nonprofits, the more their employers will also give to those organizations.

What Are the Benefits of Corporate Giving Programs?

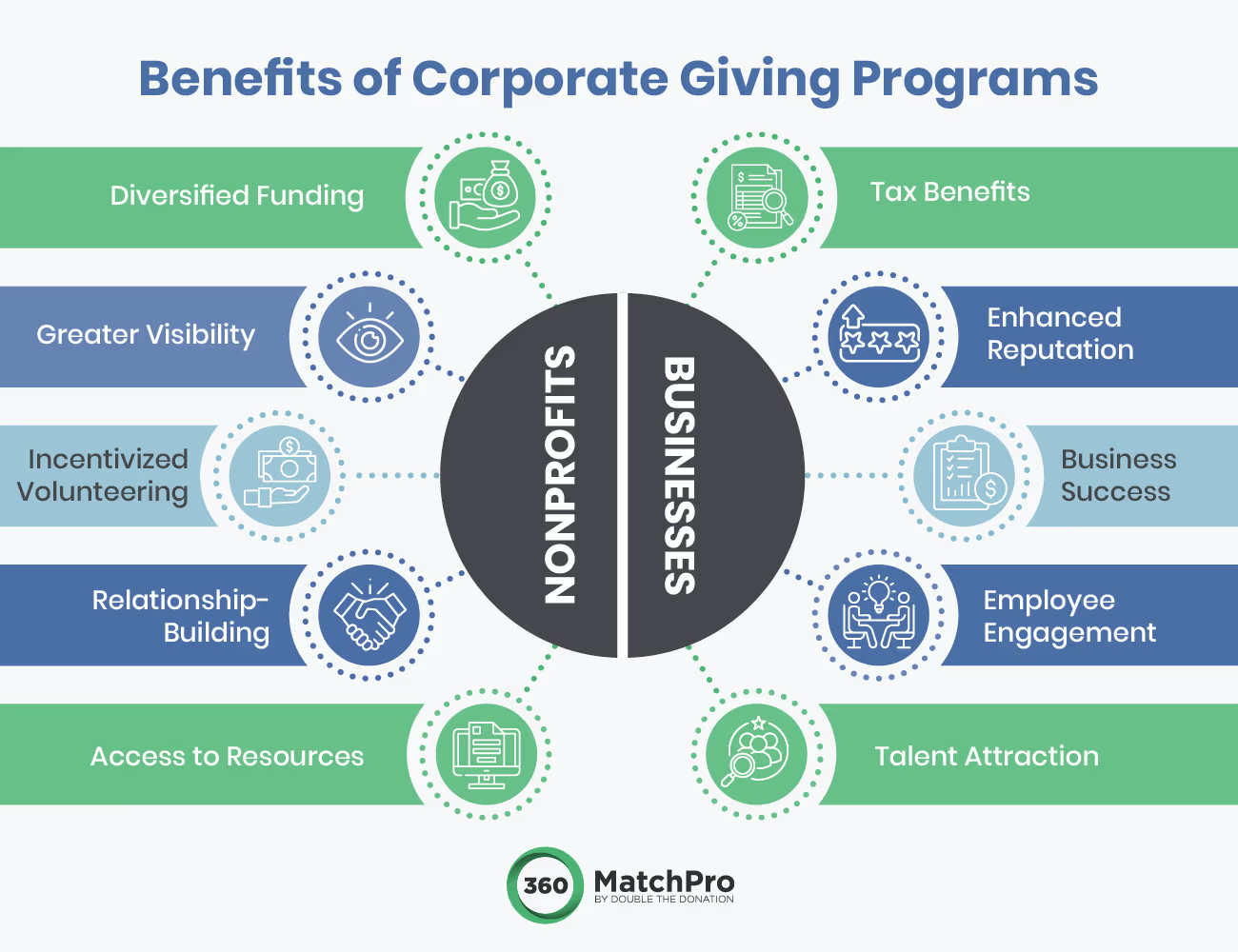

Corporate giving has many advantages for both nonprofits and businesses. Let’s take a closer look at the benefits each type of organization receives:

For Nonprofits

The biggest benefit of corporate giving programs for nonprofits is financial support. Annually, the top ten companies donate over $2 billion to nonprofits through these programs, making corporate giving an important opportunity.

However, that’s not all nonprofits get through corporate giving programs. Other benefits include:

- Diversified funding. Although many nonprofits focus on fundraising through individual donors, receiving funds from businesses allows these organizations to diversify their funding. This helps them achieve sustainable growth and become more financially stable.

- Greater visibility. Since businesses receive a boost in reputation from being associated with charitable giving, they’ll advertise their nonprofit partnerships to their employees and customers. This provides the nonprofit with access to these audiences, greatly broadening their reach.

- Incentivized volunteering. A few corporate giving programs, such as volunteer grants, incentivize business employees to volunteer at eligible nonprofits. This gives nonprofits access to a greater pool of volunteers willing to further their mission.

- Relationship-building. Nonprofits that connect with businesses through corporate giving programs have the opportunity to strengthen that relationship, earning greater support over time. Plus, businesses may be able to refer the nonprofit to other charitable-minded companies, expanding their network.

- Access to resources. Businesses often have access to resources that nonprofits do not, usually due to budgetary reasons. Companies that have corporate giving programs may be willing to share these resources and their knowledge with nonprofits. For example, a charitable-minded marketing agency may be willing to teach nonprofit professionals how to promote their fundraising efforts.

Corporate giving is extremely advantageous for nonprofits. Take the time to learn more about giving programs and form connections with businesses to ensure that your nonprofit is eligible to receive their support.

For Businesses

Many individuals wonder why businesses participate in corporate giving programs. After all, it’s clear how these programs are advantageous for nonprofits, but it seems that businesses don’t gain very much and should only start these programs if they’re particularly charitably minded.

However, CSR programs impact businesses in a variety of ways. Some of the benefits of creating corporate giving programs include:

- Tax benefits. Many of the funds that businesses donate to nonprofits are tax-deductible, creating a financial incentive for them to create corporate giving programs.

- Enhanced reputation. Working toward social good enhances a business’s reputation, showing that it cares about more than just profits. As 70% of Americans believe it’s important for companies to improve the world, having corporate giving programs means consumers are more likely to look favorably on your company.

- Greater business success. With 77% of consumers motivated to purchase from companies committed to making the world a better place, participating in corporate philanthropy is evidence that a business is invested in social good. Corporate giving programs prove a company’s investment in social responsibility, leading to increased customer loyalty and greater business success.

- Employee engagement. Participation in social good creates a stronger connection between employees and their workplace, as 93% of employees believe that companies should lead with purpose. This results in more productive and happier employees.

- Talent attraction. Strong corporate giving programs allow your business to stand apart from the competition, not just for customers but also for potential employees. After all, nearly 70% of employees say they wouldn’t work for companies without a strong purpose, and 90% of employees who work at companies with a strong purpose are more inspired, motivated, and loyal.

Regardless of whether you work for a nonprofit or company, you should know how each organization benefits from corporate giving programs. That way, you’ll have a greater understanding of what makes these programs important for the other side, facilitating meaningful collaboration to positively impact the world.

Types of Corporate Giving Programs

Now that you understand the benefits of corporate giving programs, let’s take a closer look at the different types of programs, starting with matching gifts.

Best for Donors: Matching Gifts

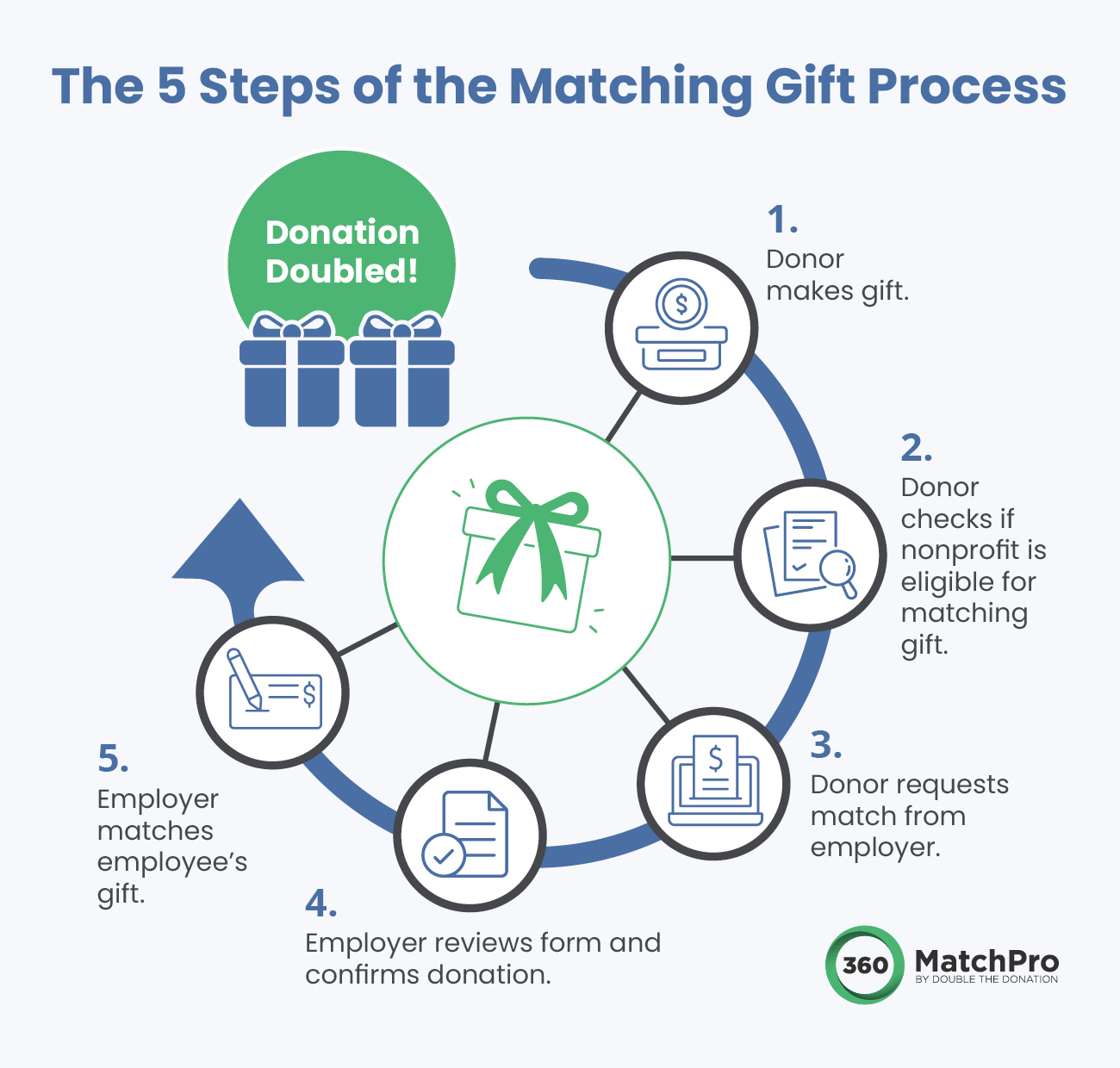

With a matching gifts program, companies match donations that their employees make to eligible nonprofits. These programs are a great way for nonprofits to double their donations without having to ask their donors for more funds.

This is how the matching gifts process usually goes:

- A donor makes a gift to a nonprofit.

- The donor checks to see if the nonprofit is eligible for a donation match based on their employer’s matching gift program policy.

- If the nonprofit is eligible for a match, the donor will fill out a match request form and submit it to their employer.

- The employer reviews the form and follows up with the nonprofit to confirm the donation.

- After the donation is confirmed, the employer matches the employee’s gift.

With matching gift programs, nonprofits can receive twice as many donations as they normally would, and sometimes even more than that depending on the employer’s match ratio. However, with $4-7 billion worth of matching gifts going unclaimed each year, awareness is the greatest obstacle to a successful matching gift program.

Whether you’re a nonprofit professional seeking matching gift funds or a business professional trying to increase employee participation in corporate giving, spreading awareness is a key step to a successful matching gifts program. Thoughtfully promote matching gifts to ensure that employees take advantage of the program. Plus, don’t be afraid to invest in tools that make the process even easier for donors.

Best for Volunteers: Volunteer Grants

Volunteer grants are corporate giving programs where businesses donate money to a nonprofit where their employees volunteer. They usually work one of two ways:

- An employer donates money to a nonprofit per hour that an employee volunteers there. For example, an employer might donate $10 per hour of volunteer time.

- An employer donates a set amount to a nonprofit after their employee meets a certain number of volunteer hours there. For example, an employer might donate $500 after an employee volunteers for 25 hours.

With the average corporate volunteer participation rate at 33%, leveraging these grants is particularly useful for nonprofits that seek more volunteers to support their missions. If you’re a nonprofit professional, remind your volunteers to apply for volunteer grants with their employers.

If you’re a business professional, incentivize volunteerism at nonprofits that you’d specifically like to support by making them eligible for your volunteer grant program. This could be smaller nonprofits who need the support, nonprofits with causes your business is interested in, or local nonprofits dedicated to improving your community.

Best for Employees: Paid Volunteer Time Off

Paid Volunteer Time Off (VTO) programs are another excellent way for companies to engage their employees while making a positive impact on their communities. By offering paid time off for volunteering, businesses demonstrate their commitment to social responsibility and employee well-being.

This is how a typical Paid Volunteer Time Off program works:

- Allocation of VTO Hours: Employees are given a set number of paid hours or days each year to volunteer with nonprofit organizations of their choice. This time is in addition to regular paid time off and sick leave.

- Employee Participation: Employees choose the nonprofit they want to volunteer with and schedule their volunteer time, ensuring it aligns with both their work commitments and the needs of the nonprofit.

- VTO Hour-Tracking: Employees use their VTO and track their hours with the organization they’re supporting. When they submit a request for their VTO reimbursement, employees are generally required to provide a log of the time they spent volunteering.

Paid Volunteer Time Off programs are a win-win for companies and communities, fostering a culture of giving and engagement that benefits everyone involved.

For employees, VTO provides an opportunity to give back to their community while receiving regular pay. This generally leads to increased job satisfaction, morale, and retention. For nonprofits, VTO programs offer a reliable source of volunteer support, helping them achieve their missions more effectively.

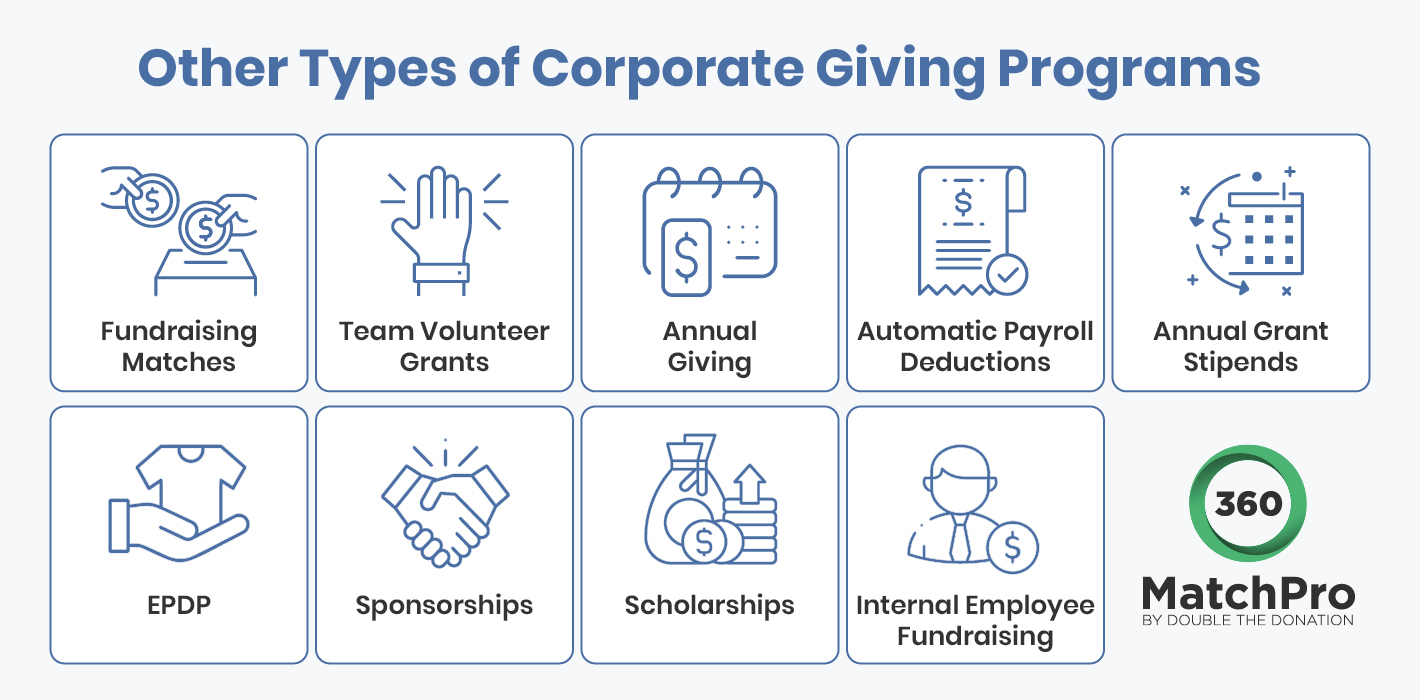

Other Types of Corporate Giving Programs

Although matching gifts and volunteer grants are the main types of corporate giving programs, that’s not to say that they’re all that’s out there. Many different types of corporate giving programs are suitable for any business’s corporate philanthropy needs.

Other types of corporate giving programs include:

- Fundraising matches. Similar to matching gifts, fundraising matches occur when a company matches the amount of money an employee raises on behalf of a nonprofit. For example, if an employee participates in a walk-a-thon and receives pledged donations based on the distance they walk, the company will match the total pledge amount.

- Team volunteer grants. This type of program rewards a group of employees who volunteer at a nonprofit together. They’ll volunteer at the nonprofit of their choice and then fill out a volunteer grant request form with their employer. From here, their employer will donate funds to the nonprofit. It’s a great team-building activity for business employees, results in more funds for nonprofits, and allows companies to show that they’re dedicated to CSR.

- Annual giving. Particularly charitable-minded businesses may encourage their employees to donate during certain times of the year, such as during cause awareness months or year-end. Nonprofits can keep track of these times to maximize the donations they acquire.

- Automatic payroll deductions. For this corporate giving program, employees can regularly donate a portion of their paychecks to a nonprofit. While this program is easy for nonprofits to benefit from, some companies may limit the types of nonprofits their employees can contribute to. This is usually intended to support causes that align with the company’s values, but it can also safeguard them from legal issues. For example, they may not allow payroll deductions that go to religious nonprofits.

- Annual grant stipends. Companies with a strong focus on corporate giving may, as part of an employee’s benefits, give employees a stipend each year to donate to nonprofits. The employee can choose how this stipend is allocated and which nonprofits receive funds.

- Employee product donation programs (EPDP). For this corporate giving program, companies will offer discounts on their products for their employees to purchase and then donate to nonprofits. This is particularly helpful for nonprofits who are seeking in-kind donations as well as financial contributions.

- Sponsorships. This is one of the most commonly referenced types of corporate giving programs, where a business decides to support a particular nonprofit financially. Usually, the funds are given for a specific purpose, such as supporting an event, activity, or program. Typically, nonprofits will submit proposals to businesses to request a sponsorship.

- Scholarships. Most suitable for nonprofits that work with students, scholarships are an offering from businesses that wish to provide funds for tuition, books, living expenses, and other education costs. These programs may require the individual student to apply for the scholarship rather than the nonprofit.

- Internal employee fundraising. Nonprofits may encourage their employees to support their cause with donations, which is known as internal employee fundraising. This allows nonprofits to increase the support they receive with little effort, as they won’t need to worry about creating dedicated marketing campaigns.

Although there are many different types of corporate giving programs, it’s unlikely that a business will offer more than a few of them. However, these programs are still worth pursuing because of the flexibility they provide nonprofits, companies, and employees alike.

How to Start a Corporate Giving Program

Starting a corporate giving program is a daunting task, containing many steps. However, if a business is serious about giving back to its community, a structured program is extremely beneficial for streamlining the process. Plus, it’s a great signal to nonprofits that you’re open to supporting their missions.

Here are the steps to starting a corporate giving program:

- Decide the objective of your corporate giving program.

- Determine which program types you want to pursue.

- Establish which employees and causes are eligible.

- Set a minimum and maximum contribution per employee.

- Craft a giving policy and submission process.

- Purchase any necessary software or technology.

- Promote your programs to your employees.

- Evaluate your programs and make adjustments as necessary.

Additionally, you’ll want to acquire leadership approval and form a corporate giving team to make the program setup more collaborative and convenient. If you’d like to learn all the details about starting a corporate giving program, check out Crowd101’s guide here. Or, if you want to look at examples of companies with successful and generous programs, we’ve compiled a list of popular companies that donate to nonprofits.

Software for Corporate Giving Programs

Depending on whether you work for a nonprofit or a business, the software you’ll want to invest in to make the most of corporate giving programs will be different. Let’s start with what tools nonprofits will find useful.

For Nonprofits: Matching Gift and Corporate Volunteerism Software

Matching gifts are one of the top types of corporate giving programs, so nonprofits should invest in solutions that make acquiring matching gifts easier. However, as mentioned before, awareness is the greatest obstacle for nonprofits to receive matching gifts.

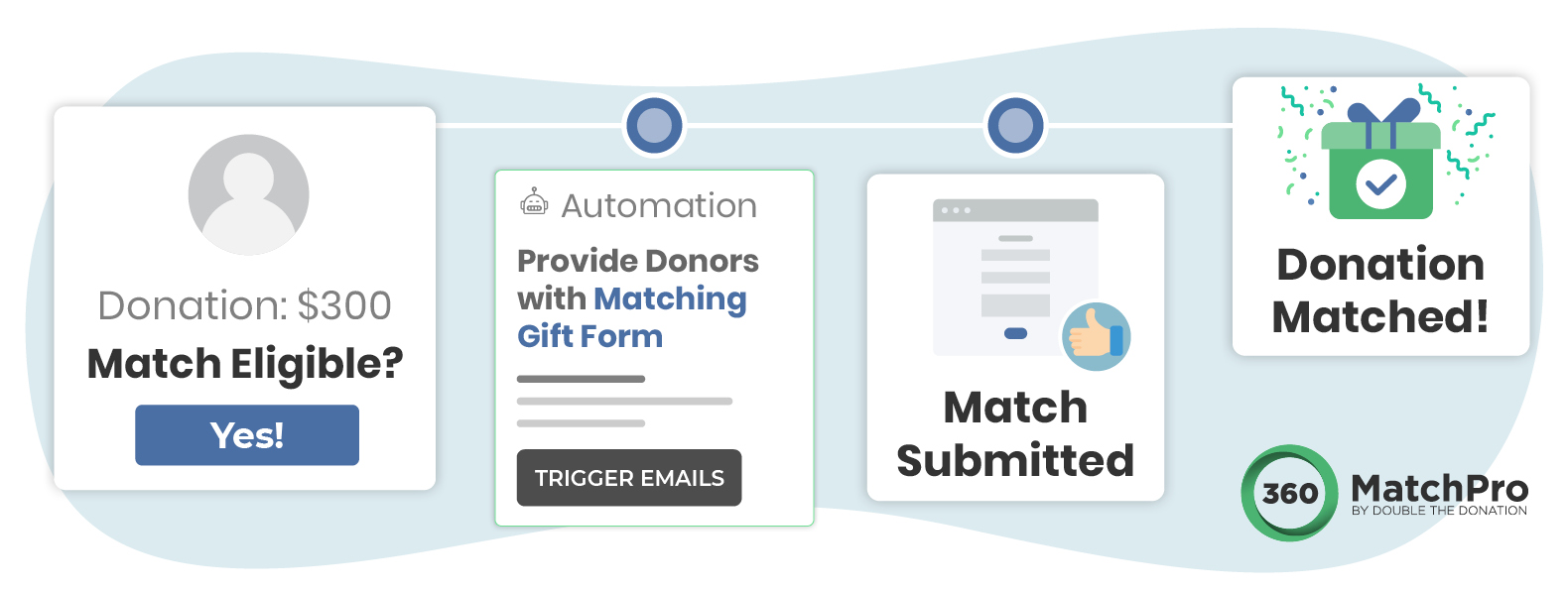

To overcome this obstacle and encourage donors to apply for matches, nonprofits must increase visibility by promoting matching gifts. Dedicated matching gift software, like 360MatchPro by Double the Donation, helps with that. Our solution streamlines the entire matching gift process and automates it for donor convenience.

This is how it works:

- After a donor makes a gift to your nonprofit, 360MatchPro will automatically scan their information and determine if they’re eligible for a match.

- Then, the platform will email eligible donors, informing them of matching gifts and advising them on how to submit a match request to their employer.

- After a request has been made, the platform will track the matching gift submission process to completion, giving your team insights and metrics you can leverage

Plus, our new auto-submission feature can handle the hard work for your donors. When donors make a gift, we’ll automatically check if their donation can be auto-submitted. If so, then donors will receive a simple screen asking them to provide some additional information and authorize us to submit a matching gift request to their employer on their behalf. This allows nonprofits like yours to acquire more matching gifts with minimal effort on your or the donor’s part.

An automated matching-gift process means you can accomplish the following:

- Identify more match-eligible donors automatically.

- Send matching gift letters straight to donors, encouraging them to complete the process.

- Save time to focus on other opportunities, such as following up with major donors.

If you’d like to learn more, check out this video on matching gift auto-submission:

With a platform like 360MatchPro, you won’t need to worry about informing your donors about matching gifts since our solution will do it for you. That way, you can generate matching gift revenue without stress!

For Businesses: CSR Software

If you’re a business professional, you’re probably looking for a flexible software solution that works with your current and future corporate giving programs. That’s where CSR software comes in. These flexible tools empower you to organize your programs, engage key stakeholders, and report on your business’s impact on the community.

When seeking out the right CSR software for your business, look for the following features:

- Donation management. Make giving easy for your employees by investing in software that allows them to donate in-platform. Plus, you should be able to offer a variety of payment options, such as credit card, debit card, and ACH. Particularly robust CSR software may even allow donors to set up automatic payroll deductions.

- Volunteer management. If your organization offers volunteer grants or other volunteering-based giving programs, volunteer management features are a must. With them, employees can log their volunteer hours, submit requests for team volunteer grants, and more.

- Campaign and program management. Manage your corporate giving programs with planning and goal features to ensure that your program makes the desired impact. Or, use these features for any fundraising campaigns you decide to host during the year.

- Reporting and analytics. Track your progress and gain valuable insights into your corporate giving programs with reporting and analytics tools. With them, you’ll be able to easily visualize data with charts and graphs, generate real-time reports for interested stakeholders, and demonstrate the impact you’re making quantitatively.

- Integrations. Invest in a CSR solution that integrates with your business’s existing tools for ease of use. For example, you might want integrations with your payroll system, employee engagement tools, and other reporting and analytics solutions.

If you’re determined to create corporate giving programs and participate in CSR, take a look at re:Charity’s guide to CSR software. In it, they dive more deeply into what CSR software is and recommend top providers for any business.

Additional Resources

Corporate giving programs are a win-win for nonprofits and businesses—nonprofits can easily gain financial support from businesses through them, and businesses gain a boost in reputation and employee engagement from offering these programs. Getting started with them may not be easy, but they can create a significant impact, making them well worth pursuing.

If you’re interested in learning more about corporate giving, take a look at these resources:

- 8 Trends in Corporate Philanthropy for 2024: How to Tap In. The world of corporate philanthropy is constantly evolving. Discover how your nonprofit can leverage generosity to power your mission.

- Measuring the Impact of CSR: Top 4 Benefits for Businesses. Not entirely convinced about participating in CSR as a business? This article gives you a rundown of what you’re missing out on.

- Developing a Matching Gift Program: A How-To Guide. If you’re interested in focusing on matching gifts at your business, this guide will teach you how to start your matching gift program.