8 Matching Gift Metrics Every Nonprofit Should Analyze

Matching gifts are a game changer for nonprofits. Recent reports indicate that an estimated $2-3 billion is donated through matching gift programs annually and a whopping 84% of donors are more likely to donate if a match is offered.

Despite all of these promising statistics, it can still be difficult to justify the resources your organization pours into outreach and marketing efforts—how do you know your time and energy are going to pay off?

This is where a comprehensive matching gift report comes in. With in-depth matching gift metrics, you can better understand the ROI of your organization’s workplace giving investments. Additional data can also offer insight into match-eligible donors while helping you crush your fundraising goals.

In this guide, we’ll explore the ins and outs of matching gift metrics, so you can evaluate and improve your matching gift fundraising efforts. Together, we’ll review:

- Why You Should Analyze Matching Gift Metrics

- How to Track Matching Gift Metrics

- 8 Matching Gift Metrics to Revolutionize Your Strategy

- How to Put Your Matching Gift Metrics to Work

- Make matching gifts work for you with 360MatchPro

Ready to get to reporting? Jump ahead to see how 360MatchPro can elevate your donor experience and activate your matching gift potential.

Why You Should Analyze Matching Gift Metrics

The point of analyzing matching gift metrics boils down to one key objective—to make data-driven decisions. An informed and well-executed matching gift strategy can have more than 75% engagement, so it’s crucial that you let actionable data guide your strategy.

Let’s check out some key benefits you can expect to activate from tracking matching gift data:

- Understand donor behaviors. Get into the minds and tendencies of your donors to find out when they are most likely to give and what motivates their generosity, and adjust your strategy accordingly.

- Predict matching gift and revenue outcomes. Figure out how much you can realistically expect to raise and formulate a strategy with these revenue goals in mind.

- Solidify fundraising goals. Based on predicted revenue from matching gifts and other fundraising projects, you can make more informed estimates and achievable goals.

- Measure the outcome of your matching gift campaigns. See the impact of your matching gift promotion efforts in real time to get a better sense of your campaign success.

- Make strategic partnerships. Pursue enhanced relationships with promising corporate leads, so you can mutually benefit.

- Promote sustainable revenue growth. Steady your revenue growth over time by choosing the most reliable and effective matching gift campaigns.

Still not sure if the analysis is worth it? Harvard reports that in a survey of more than 1,000 senior executives, highly data-driven organizations were three times more likely to report significant improvements in decision-making compared to those who rely less on data.

So, if your nonprofit is accepting matching gifts without paying attention to the metrics, you’re likely missing out on valuable insights.

How to Track Matching Gift Metrics

Out of all the donations a nonprofit organization receives, only around 1.31% are typically matched by donors’ employers—even though ten times that amount generally qualifies for matching.

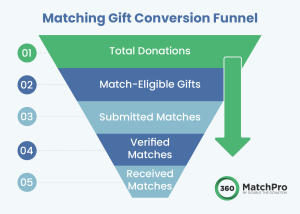

So how do you discover where the discrepancy comes in? By analyzing the matching gift conversion funnel to track progress. Here’s what it looks like:

Let’s break down each of these stages:

- Total individual donations. This measures your regular donation flow on a monthly, quarterly, and annual basis, so you can be better prepared to measure matching gift performance proportionally.

- Total match-eligible donations. Donor employment information can help discern which companies offer matching gift programs. Use this data to determine which of your donors are match-eligible either by conducting a manual search or by using a matching gift database.

- Submitted matches. This measures how many matching gift requests your donors are actually submitting. If your matched donations do not align with your requests, this could be due to missed deadlines, corporate stipulations, or donors reaching their annual maximums.

- Verified matches. This stage indicates the amount of matched donations that are verified by donors’ companies. Unverified matches can get lost in the process, so keeping track of this metric ensures you’re not missing out.

- Received matches. The matching gift donations that make it all the way through the conversion process fall into the received or “match completed” category.

Getting matching gifts from the top to the bottom of the funnel can be tricky—that’s why having dedicated software helps you avoid roadblocks. Matching gift processes like auto-submission and other innovative technology can even help you skip a step by automatically submitting matches!

Before moving forward, calculate how many of your current donations fall into each category, then bookmark it for the next section.

8 Matching gift metrics to revolutionize your strategy

Aside from your individual matching gift status, your matching gift coordinator should evaluate these key metrics as well. Then, assess them as a team, so you can adjust your matching gift engagement strategy based on your learned insights.

Keep in mind that these metrics are most easily tracked using matching gift software that can double-check calculations, verify totals, and contextualize metrics. That said, let’s dig into how to calculate key matching gift metrics:

1. Total Number And Value of Matching Gifts

This is the combined count and monetary value of all matching gifts received within a specific time period. Or, the amount of matching gifts that comprise the “received match” category of the conversion funnel. Here’s how you calculate this value:

Formula: Add the sum values of every matched donation

Match 1 ($25) + Match 2 ($40) + Match 3 ($100) + Match 4 ($1000) = Total Number and Value of Matching Gifts

In the example above, the number of matching gifts would be four and the monetary value would amount to $1,165. These measures provide an overview of your matching gift participation and monitor the overall health of your fundraising programs.

2. Matching Gift Eligibility Rate

This metric is the percentage of your donors or supporters who are eligible for matching gifts from their employers. Whenever there is a gap between the total number of matching gifts and total match-eligible donors it represents an opportunity for your organization to uncover missed matches. Here’s how to calculate matching gift eligibility rate:

Formula: Divide your match-eligible donor count by the total number of individual donors and multiply it by 100.

(Match 1 + Match 2) / (Match 1 + Match 2 + Ineligible Gift 1 + Ineligible Gift 2) = %

Measuring the number of donors that are marked as eligible within your matching gift database can help you decipher any matching gift leads you need to pursue.

3. Matching Gift Completion Rate

This metric reveals how many matching gifts are successfully completed compared to ones that are not. Here’s how to calculate it:

Formula: Divide the number of completed matches by the total number of eligible donors

(Match 1 + Match 2) / (Eligible Gift 1 + Eligible Gift 2 + Eligible Gift 3) = %

You can increase the number of donors that actually complete a matching gift request by using matching gift software to track matching gifts through the conversion process to figure out when donors initiated and verified their matches.

4. Average Matching Gift Amount

This number represents the mean value of the matching gift donations received. Refer back to your Total Number of Matching Gifts and Total Value of Matching Gifts from metric #1. Then, follow this formula to calculate:

Formula: Total Value of Matching Gifts / Total Number of Matching Gifts

$50 + $50 + $150 + $30 + $100 (value of matches) / 5 (Number of completed matches) = $76

Getting to the average dollar amount of a matching gift can put your matching gift fundraising efforts into perspective and provide insight into the level of donors participating in your programs. A lower Average Matching Gift Amount indicates that you might be targeting donors with smaller giving capacities. Although their donations are definitely needed, it might be time to begin targeting larger donors. Use matching gift software to dig deeper into your donor segments and giving levels, so you can get a better understanding of where this figure comes from.

5. Revenue Increase Due to Matching Gifts

This matching gift metric indicates the increase in total fundraising revenue as a result of matching gifts, here’s how to calculate it:

Formula: Subtract the value of your completed matching gift donations from your total fundraising revenue. Then, divide your total matching gift revenue by the total revenue without matching gifts.

Total Fundraising Revenue ($20,000) – Matching Gift Revenue ($4,000) = Revenue with Matching Gifts ($16,000)

Matching Gift Revenue ($4,000) / Revenue without Matching Gifts ($16,000) x 100 = 25%

Although slightly more involved, this calculation is important to determine the additional funds raised due to matching gift programs, which directly communicates the impact of your matching gift programs.

6. Matching Gift Retention Rate

This number refers to the percentage of donors who complete a matching gift on your behalf in one year and then repeat the action in the next year.

Determine the number of matching gift donors who had their gifts matched in the most recent time period that also had their gifts matched in the period before. This means you’ll need to have matching gift reporting on hand for at least the two previous years. Here’s how the numbers fit together:

Formula: Repeat matching gifts from this year (Match 1 + Match 2 + Match 3) / Matching gifts from last year (Match 1 + Match 2) = %

This metric assesses your matching gift performance over time, analyzing the number of donors who stick around year after year.

7. Growth in Matching Gifts Over Time

This metric measures how well your matching gift programs are performing over time using the previous period’s total matching gift value from the current period’s value. Here’s what it looks like:

Formula: Current period’s matching gift total ($5,000) – Previous period’s matching gift total ($3,000) = YOY increase ($2,000)

YOY increase ($2,000) / Previous period’s matching gift total ($3,000) x 100 = 67% YOY growth

This metric is especially helpful to discover how your nonprofit’s matching gift relates to your overall fundraising. Using matching gift software, you can easily track matching gift trends whether it’s an increase in matches, fundraising total, or both.

8. Matching Gift Fundraising ROI

Matching gifts are reliable sources of funding, but to really capitalize on them, your nonprofit will likely need to invest additional funds and time into promotion. Using this metric, you can calculate the return on those initial investments.

Simply subtract the cost of managing and promoting the opportunity to your donors from the total revenue generated through matching gifts. Divide the result by the initial cost, then multiply by 100, like this:

Formula: Revenue generated from matching gifts – Initial cost of matching gift fundraising / Total cost x 100 = %

[Matching gift revenue ($10,000) – Initial cost of matching gift fundraising ($1,000)] / Total cost ($2,000) x 100 = 450%

Evaluating the performance of your program to generate additional funds in relation to your investments can help you determine if you need to invest further or pull back.

How To Put Your Matching Gift Metrics to Work

Now that you’ve completed your matching gift metric calculations, it’s time to put them to work! This means you’ll want to sift through your data more carefully to find key insights that can help you make the most out of your matching gift strategy.

More specifically, your data should help you across the following categories—promotion, donor retention, and corporate outreach.

Matching Gift Promotion

By investigating your matching gift data set, you can tailor your marketing strategies based on your findings. Metrics like Total Number (and Value) of Matching Gifts and Matching Gift Fundraising ROI can give you a baseline for how well your marketing strategies are performing.

From there, you can dig deeper into matching gift participation rates and see what causes might be lurking behind lower rates. For instance, you might find that the discrepancy behind your match-eligible donors and matching gift completion rate might be from a general lack of awareness.

In this case, your organization could decide to adopt a multichannel marketing strategy where you not only promote matching gifts via email and your website, but also try out new strategies like social media and search ads.

Then, once your program becomes more established, you can track the number of matched donations coming through from each channel. For example, maybe the channel that drives the highest traffic is search ads. In this case, you might look into pursuing the Google Ad Grant to reach more audiences and increase awareness faster.

Donor Retention

Seeing who is responsible for your largest matches is incredibly helpful for adjusting your retention strategy. As you gather more information about your matching gift donors, continue to analyze your database to get an idea of which match-eligible donor relationships to prioritize.

Although using automation can help you manage multiple relationships at once, it’s worth it to personalize your messages for your top donors. What constitutes a “top” donor can also look different across nonprofits. For you, this could refer to donors who work for a company with a high matching cap. For other nonprofits, this might mean a mid-level donor whose employer offers a triple match.

For donors, that fall into this category, you might decide to personalize your communications with phone calls, dedicated appreciation gifts or letters, or even face-to-face meetings to thank them for their support and inform them of their impact.

Corporate outreach

Just as individual donors can make a substantial mark on your programs, the same is true for corporate partners. So, leading business affiliations can help you skyrocket your matching gift programs quickly and sustainably.

Your donors, who work for the same philanthropically-minded business, may be your best advocates for strengthening these partnerships. Encourage them to promote your nonprofit and suggest other opportunities like volunteering that can strengthen your connection to their employer.

By paying attention to these specific components within your matching gift metrics, you can make strategic engagement and promotional decisions. Then, continue to monitor your metrics to see how your new strategies affected your data.

Make matching gifts work for you with 360MatchPro

Now that you know what to look for in your matching gift metrics, how can you get started? To avoid completing these calculations by hand, we recommend choosing reliable reporting tools your team can keep handy like 360MatchPro by Double the Donation.

360MatchPro is a go-to for several nonprofit organizations looking for an easy way to track and optimize their metrics. Specifically, it streamlines the whole process by automatically identifying and triggering personalized outreach to eligible donors and following their matches to completion. Here’s a closer look at how the platform works:

360MatchPro’s integration with fundraising tools makes implementation simple. And, as a comprehensive database, 360MatchPro offers access to insightful reports that visualize your matching gift metrics and provide a recommended next action. Here are a few pre-built reports your nonprofit can analyze:

- Leading Companies Report: Identifies the companies that could become a closer partner to your organization.

- Eligible But Not Submitted Report: Indicates the most valuable groups of donations that are eligible, but have not submitted matching gift requests.

- Repeat Donors Report: Illustrates donations from donors who have submitted requests for previous donations, but have other gifts that have not been matched.

- Campaign Comparisons Report: Shows the percentage of match-eligible donations identified in each of your organization’s campaigns to determine which one is performing the highest.

- Miscategorized Ineligible Donors Report: In the case of a donor mistakenly determining that their employer does not offer a matching gift program, this report shows which donors are eligible, but have been wrongfully categorized as ineligible.

- General Statistics Report: Indicates email open rates and click rates, match identified donations by month, and status breakdown to determine where your donors are in the conversion process.

These reports make it easy for you to get the most out of your matching gift programs and tap into more data-driven decisions. Plus, with a streamlined donor outreach process, you’ll quickly fill in gaps so your donors can match their donations without unnecessary delays.

Matching Gift Metrics: Final Thoughts

Data is a goldmine when it comes to matching gifts. But, without the right tools to track and organize that data, your organization can feel stuck wading through metrics. Collaborate with your team to decide on a system that works best for you, so you can make sense of your incoming analytics quickly and easily.

As you iron out your plan, continue to monitor your data on a regular basis to identify missed opportunities and resolve any inconsistencies. You’ve got this!

Want to expand your matching gift knowledge? Keep learning with these resources:

- Matching Gift Auto-Submission + CSR Platforms I What to Know: Learn how auto-submission can enhance the donor experience and earn you more matching gift revenue in this in-depth guide.

- Top 24 Matching Gift Companies: Leaders in Philanthropy. Wondering who the top names in corporate philanthropy and matching gifts are? Check out our list of these matching gift companies that with a reputation for quality philanthropy.

- How to Unlock More Social Impact With Corporate Philanthropy: When nonprofits and businesses work together to promote social good, it’s a powerful force. Read this article to learn how each plays a role in corporate philanthropy.