Why Companies Should Implement Payroll Giving Programs

Many people want to donate but simply forget to do so. This is especially true for people with busy work schedules. Fortunately, you can make it easy for your employees to give back by implementing a payroll giving program.

Payroll giving is a type of corporate social responsibility (CSR) program that benefits businesses, nonprofits, and employees. In this guide, we’ll break down the basics of how a payroll giving program works and why your business should consider launching one.

What is Payroll Giving?

Payroll giving, also called automatic payroll deductions, is a CSR program some businesses offer that allows employees to opt into having a portion of their paychecks automatically deducted and donated to a nonprofit organization. Usually, the amount deducted is a percentage, but some CSR tools allow employees to donate a set dollar amount instead. Companies also usually vet nonprofits to create a list of trustworthy organizations their employees can donate to.

How Does Payroll Giving Work?

Your business will need to set up the initial payroll giving system, but once employees are enrolled, your CSR software or payroll management system will essentially run the program with little to no input needed.

To get started with payroll giving, follow these steps:

- Invest in CSR software. If your payroll system doesn’t offer charitable giving functionality, choose a CSR platform with automatic payroll deduction tools. Look for software with employee self-service tools that let staff opt in and out of payroll giving themselves rather than having to contact a software administrator.

- Select nonprofits to support. Research nonprofits and select organizations your business and employees will want to support. To ensure all employees have a cause they care about represented, choose a variety of nonprofits and let employees pick which one their automatic donations will go to.

- Employees enroll. When new employees join your business, give them the opportunity to enroll in payroll giving. Additionally, make the option to enroll, stop, increase, or decrease payroll giving available to all of your employees at all times.

- Donations are collected automatically. Once an employee opts in, your CSR software will automatically process the donation for every paycheck. The CSR vendor will send out payments to nonprofits, so your business can take a set-it-and-forget-it approach.

To track your employees’ total giving, look for CSR software with reporting features. This will allow you to monitor how many employees are enrolled in payroll giving and how much they’ve individually and collectively contributed. You can use this information to thank employees for their generosity, highlight your teams’ commitment to social good, and explore what causes resonate with your staff.

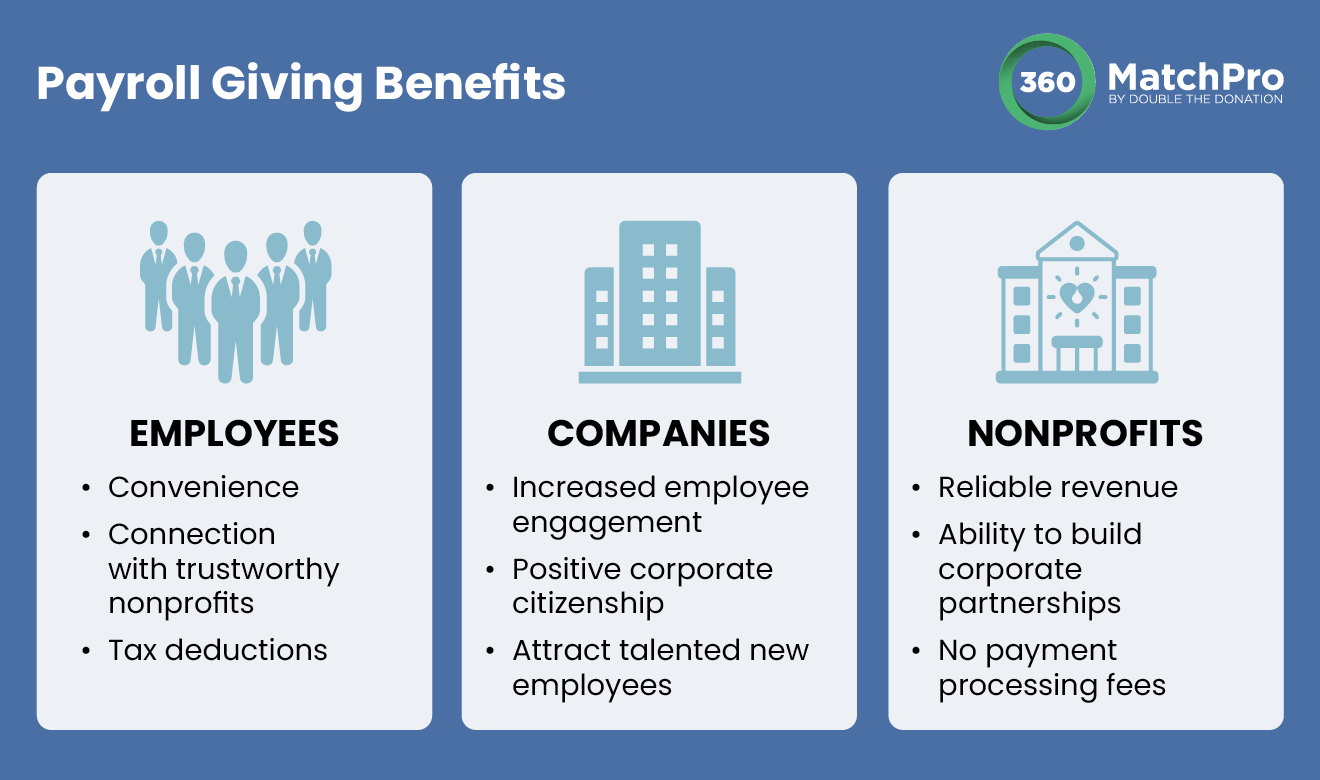

Payroll Giving Benefits

Payroll giving benefits everyone involved. Here’s a breakdown of the specific positives employees, companies, and nonprofits can look forward to when a payroll giving program is implemented.

Employees

Employees who opt into payroll giving can dramatically simplify the donation process for themselves and experience the following benefits:

- Convenience. Payroll giving is one of the most convenient ways to support nonprofits. Employees simply enroll when hired or when your company rolls out its program, select how much they would like to contribute, and let the CSR software handle the rest. If employees want to opt out for any reason, they should be able to easily change their enrollment status.

- Connection with trustworthy nonprofits. While corporate giving programs that only support specific nonprofits reduce flexibility, employees who participate in these programs can rest assured that they are contributing to a reputable organization.

- Tax deductions. Payroll donations are tax deductible. The business’s CSR software or payroll system should help employees track how much they’ve donated, allowing them to accurately report their giving on their taxes.

Individual donors have several options when it comes to giving back. To engage your entire team, offer other corporate giving programs, such as matching gifts and volunteer grants, in addition to payroll giving.

Companies

Ultimately, employees are the ones donating through payroll giving programs, not the companies. However, businesses can still experience several benefits related to CSR by offering a payroll giving program, including:

- Increased employee engagement. Programs that allow employees to give back to the causes they care about increase employee engagement, retention, and productivity. Charitable giving is proven to improve morale. In fact, employee engagement levels are 13% higher at companies that invest in CSR programs.

- Positive corporate citizenship. When your business publicly encourages giving and contributes to your local community, your organization will be seen as a leader in positive social impact, leading to a reputation boost.

- Attract talented new employees. Civic-minded job seekers will see payroll giving programs as a sign that their prospective employer shares their values related to giving. This can help businesses attract more talent and keep them engaged.

If your business is experiencing low payroll giving participation rates, you can incentivize participation in a few ways, such as matching employee contributions.

Additionally, some businesses offer a unique type of payroll giving where employees donate to a fund that employees who experience sudden financial hardship—such as in the event of a natural disaster—can apply for to earn relief. This is known as an employee relief fund program. A prominent example of this is clothing retailer Ross’s Ross Care Fund, which provides support to employees impacted by disaster or personal hardship.

This approach allows employees to fund a cause that direcly impacts their lives. When selecting nonprofits for your payroll giving program to support, consider what nonprofits and causes will resonate with your team.

Nonprofits

While payroll giving programs usually only support a handful of nonprofits, the organizations that are chosen can look forward to these benefits:

- Reliable revenue. Nonprofits already encourage donors to enroll in recurring giving, which is a type of donation that is processed automatically every month. Payroll giving is incredibly similar to recurring giving, and both types of donating provide nonprofits with reliable revenue.

- Ability to build corporate partnerships. When a business chooses a nonprofit to participate in a payroll giving program, the door opens to other substantial corporate giving agreements in the future, such as a sponsorship.

- No payment processing fees. Most online donation processors charge a transaction fee for popular types of payment methods, such as credit cards. When donations are made straight from a payroll system, there are no processing fees, meaning the entire donation is given to the nonprofit.

Additionally, active nonprofits can use payroll giving as an opportunity to encourage supporters to explore matching gifts. Matching gifts are a type of corporate giving where businesses agree to match the donations their employees make to nonprofit organizations, usually at a 1:1 rate.

Companies with payroll giving programs have a demonstrated investment in employee giving initiatives and might also have a matching gift initiative. If your company offers matching gifts, you can streamline the giving process even further by investing in a CSR software solution that has matching gift auto-submission capabilities.

Payroll giving speeds up the donation process by making giving automatic, and auto-submission speeds up the matching gift process by making filling out the application automatic. To learn more about how this cutting-edge corporate giving technology works, check out this video from our team at Double the Donation:

More Employee Giving Resources

Payroll giving is one of the easiest ways to encourage employee giving. Employees can enroll to start making contributions and know that your CSR software is handling the rest. As a result, your business can give back to worthwhile causes and connect with charitable-minded employees.

Of course, payroll giving isn’t the only employee giving program. For more information on these types of initiatives, explore these resources:

- Winning Workplace Giving Strategies & How to Leverage Them. Expand your workplace giving strategies beyond payroll giving. Learn how to motivate your employees to give back to their communities.

- Engaging Your Employees With Employee Engagement Software. Payroll giving is just one software solution for boosting employee engagement. Explore other technology-driven engagement programs.

- How to Craft a Complete Corporate Charitable Giving Policy. Your charitable giving policy creates a framework for your company’s charitable contributions. Discover how to create this essential document for corporate giving.