How You Can Unlock the Power of Corporate Matching Donations

Stop and think for a second: how many revenue sources does your nonprofit have? Do you primarily rely on contributions from individuals? Have a few grants? Maybe a corporate sponsor?

Ideally, your nonprofit should have access to these channels and potentially even a few more income streams. By diversifying your revenue, your nonprofit will have greater stability, ensuring you’re able to continue fulfilling your mission in the event of a fundraising shortfall.

One commonly overlooked revenue stream nonprofits can easily tap into is corporate matching donations. For other sources of income, your nonprofit might have to establish an entirely new system for courting and maintaining it. But matching donations just require the right software and marketing cadence.

In this guide, we’ll go over everything your nonprofit needs to know to maximize your revenue and harness the power of matching gifts, including:

- Corporate Matching Donations FAQ

- How Corporate Matching Donations Work

- Tips to Maximize Your Matching Gift Strategy

- Examples of Corporate Matching Donation Programs

Corporate matching gift programs are already everywhere, just waiting for your nonprofit to access them. Earn more revenue, improve donor relationships, and improve your nonprofit’s stability with this underutilized income source.

Corporate Matching Donations FAQs

While corporate matching donation programs are common, only 1.31% of contributions to the average nonprofit get matched. With low numbers like these, it’s clear there’s a gap in knowledge and communication. To alleviate this issue, let’s go over a few corporate matching gifts basics.

What are corporate matching donations?

Corporate matching donations are a type of corporate philanthropy. More commonly known as matching gifts, these are monetary contributions businesses make after an eligible employee donates to a nonprofit’s cause. These donations are facilitated through a business’s corporate matching gift program, which establishes guidelines for what types of nonprofits the business will match gifts for, which employees are eligible to receive matches, when match applications must be submitted, and so on.

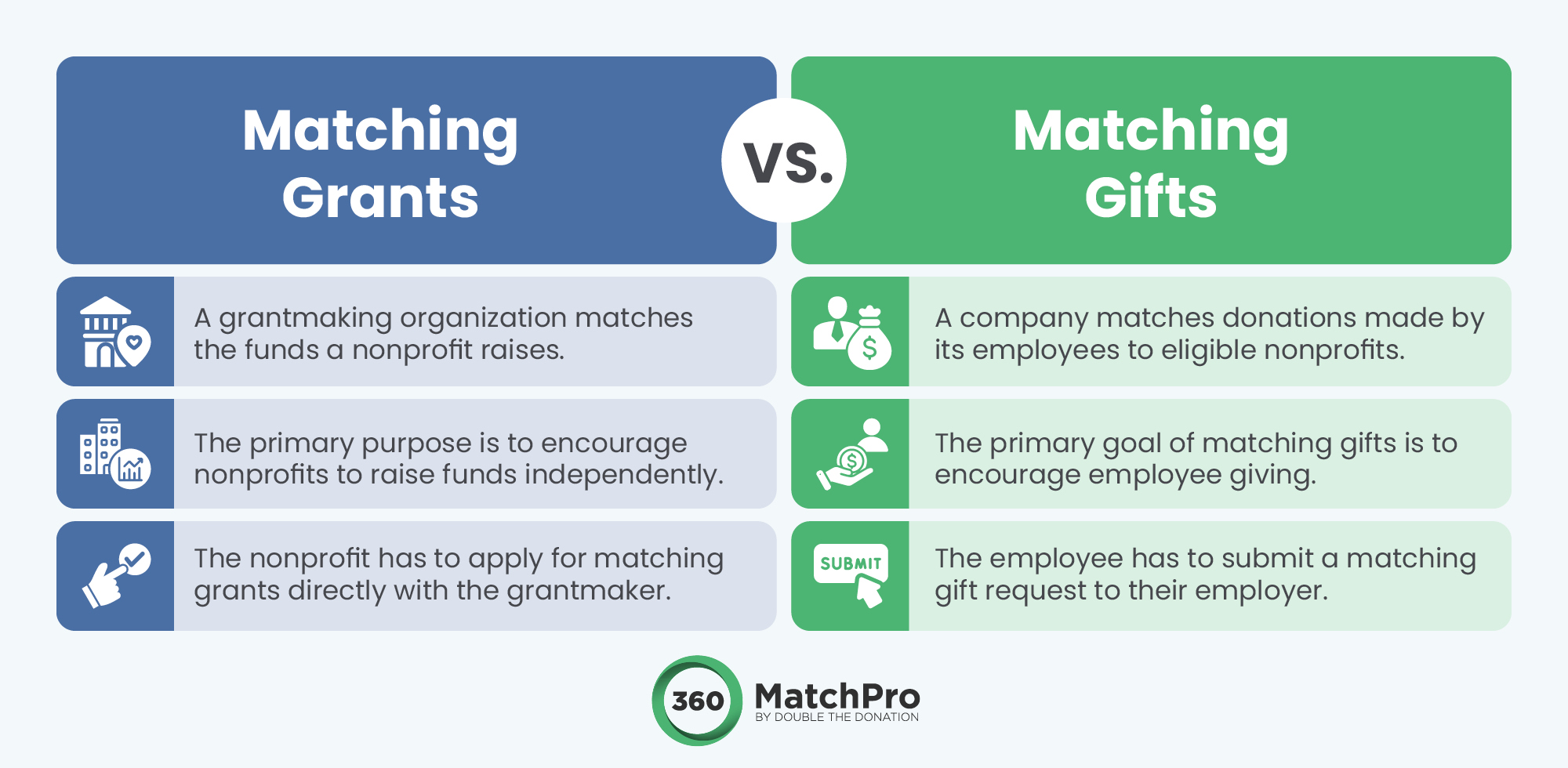

Don’t confuse corporate matching gifts with corporate matching grants. While gifts are matches for an individual employee’s gifts, grants are an arrangement businesses make with specific nonprofits to match all incoming donations for a specific campaign or over a set period of time.

For instance, Company A’s matching gift program causes them to match all donations full-time employees make. Company B’s matching grant program requires them to match all donations an animal shelter receives in the month of August, regardless of whether those donors have any connection to Company B.

Why should nonprofits include matching gifts in their fundraising strategy?

As mentioned, matching gifts are essentially free extra revenue nonprofits can access to improve their stability. With this funding boost, nonprofits will have more room in their budget to pursue their missions, launch new projects, and drive impact.

Consider the effort it takes to attract a new donor. Let’s say on average, it takes about $50 to earn one new recurring donor, who then gives $15 each month. That donor pays for themself after about four months of giving. However, if they qualify for a matching gift, they’re now instantly giving $30 a month, making up your investment in just two months.

And that’s just for a hypothetical new donor. Imagine all of your current supporters, especially those at the higher end of your giving range, doubling their impact overnight.

Corporate trends also point toward matching gifts growing in popularity among businesses of all sizes, meaning a donor whose employer doesn’t have a corporate matching gift program today might offer one tomorrow.

How do I know if my nonprofit is eligible for corporate matching donations?

Each business sets its own match eligibility criteria, meaning a nonprofit that qualifies for one company’s matching gift program might be ineligible for another. In general, most companies require charitable organizations to be registered nonprofits—which means having 501(c)(3) status in the U.S.—and typically religious and political organizations are excluded.

Plainly, your nonprofit cannot keep track of every corporate matching gift program’s individual guidelines. Instead, nonprofits use matching gift databases so supporters can quickly look up their specific employer.

Why do companies offer matching gifts?

While matching gifts are free revenue for nonprofits, they don’t outright financially benefit the corporations making these payouts. This might cause you to wonder just why a business would offer one of these programs.

Corporate matching donations are an act of philanthropy, but be aware that most companies offer them as a strategic business decision since they provide the following benefits:

- Reputation. Consumers want to make ethical shopping decisions, and companies with positive philanthropic reputations can earn more from these customers. By making donations through matching gifts, businesses can let customers know they set aside a portion of their proceeds to support a variety of causes.

- Employee engagement. Just as customers want to buy from companies that make charitable contributions, employees want to work for those same companies. Businesses that give their employees a hands-on way to make an impact through their work see increased employee engagement, leading to higher productivity and retention rates.

- Tax benefits. Matching donations to 501(c)(3) organizations are tax deductible. Both businesses and their employees can claim these contributions on their tax forms to their financial benefit.

Of course, companies can partake in any number of philanthropic activities to access benefits like these. Many choose corporate matching donations because they work so well with employee giving programs, which are fairly easy to set up. By promising to match donations, corporations can increase employee participation, boosting their charitable impact with little effort.

How Corporate Matching Donations Work

Matching gifts benefit your nonprofit, your donors, and the companies that provide them. So how exactly does a matching gift get submitted to your nonprofit?

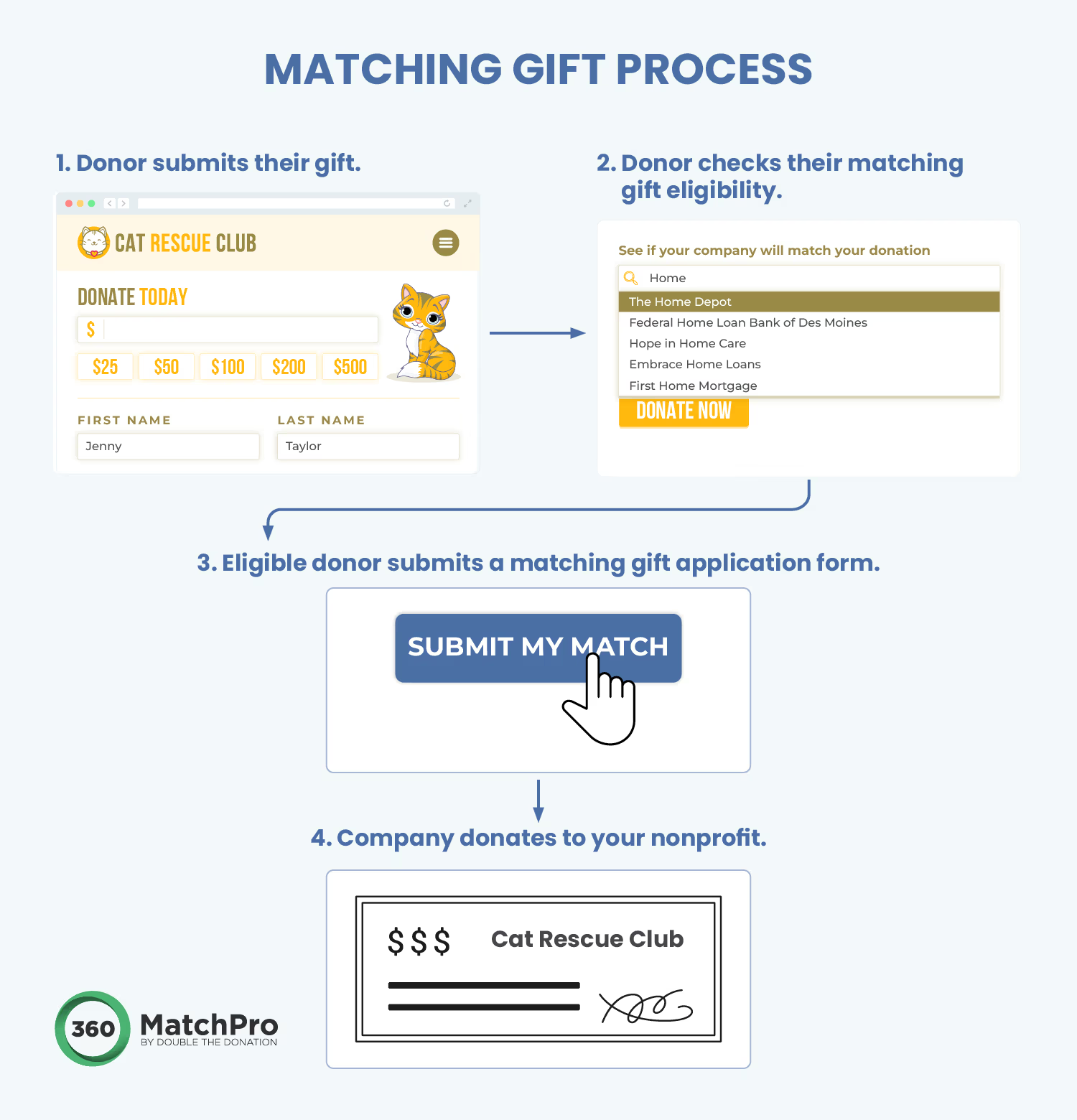

Essentially, every matching gift follows the same four steps:

- Step 1: Donors submit their gift. Supporters navigate to your nonprofit’s online donation portal and contribute like they normally would.

- Step 2: Donors check their eligibility. After the initial donation has been processed, donors can begin the matching gift process. First, donors need to be aware of the concept of corporate matching donations and check whether they qualify. If your nonprofit has partnered with a matching gift software provider, they can use your matching gift platform to look up their employer. Embedding a matching gift database search tool into your donation form can help market matching gifts, resulting in more matches. For nonprofits without matching gift software, donors will need to look up their eligibility themselves.

- Step 3: Eligible donors submit a matching gift application form. Some matching gift software platforms, like 360MatchPro, can pair donors with their employers’ matching gift application forms. These forms generally request information about the employee and donation, such as the employee’s name, donation amount, and the type of nonprofit they gave to.

- Step 4: Companies donate to qualifying nonprofits. After submitting their matching gift application by the company’s deadline, employers will review matching gift applications and approve donations to eligible nonprofits. At this point, a donation will be sent to your nonprofit, usually either in the form of an online gift or a physical check in the mail.

While it takes some added effort to secure matching gifts, the process isn’t all that complicated, so it’s certainly worth your time. After all, you don’t want to leave free money on the table!

Simplifying the Matching Gift Process With Auto-Submission

This might seem simple, but there are multiple stumbling blocks in this process. In particular, it’s common for donors to discover they’re eligible for a matching gift but not complete a donation request form. While these forms are usually straightforward, they do require extra effort to hunt down and fill out.

Nonprofits can cut out this step for some donors through the latest technology in matching gifts: auto-submission. Double the Donation is proud to be a pioneer of matching gift auto-submission technology, empowering 360MatchPro customers to let their donors have the matching gift process completed for them.

Essentially, Double the Donation has partnerships with a number of CSR software vendors. Companies that leverage these vendors’ platforms can enable matching gift auto-submission for their employees. Then, when an employee makes a donation to a nonprofit that uses 360MatchPro, they’ll be able to opt into auto-submission and have their matching gift application filled out instantly.

For a more thorough breakdown of how this innovative tool works, check out our video on the subject:

Tips to Maximize Your Matching Gift Strategy

Matching gifts are a highly convenient fundraising source, but they’re not something your nonprofit can just set up and forget about, especially when you’re first getting your matching gift strategy off the ground.

To maximize corporate matching donations, follow these tips:

Invest in matching gift automation software

It is possible for a donor to submit a matching gift to a nonprofit that lacks software. However, to do so, the donor needs to be aware of matching gifts and have the drive to research their eligibility and complete their employer’s application form themselves.

While some charitable go-getters might have the initiative to follow these steps without any prompting, the vast majority of your donors will need some help, which is where software comes in. Look for a matching gift database that offers the following features:

- Large matching gift database. A matching gift database is only worthwhile if it contains valuable employer data. Look for matching gift software that’s routinely updated and has information on as many matching gift programs as possible. Double the Donation is proud to announce that 360MatchPro has up-to-date data on 99% of U.S. and 95% of Canadian corporate matching gift programs, as well as many more across the globe.

- Auto-submission. As discussed, auto-submission is the future of matching gifts. The more CSR programs that adopt auto-submission technology, the more donors will be able to complete their gifts instantly, meaning more revenue for your cause.

- Marketing automation. For donors who don’t qualify for auto-submission, matching gift software with marketing automation still provides the tools for seeing match donations through to completion. Set up messages to be sent out to donors, alert them to check their match eligibility, complete their employer’s application form, and thank them once a donation is received.

360MatchPro, of course, offers all of these features as well as integrations with an extensive range of software vendors in the nonprofit space. This means you can likely embed your 360MatchPro database search tool into your current donation form and fundraising software with ease.

Market your matching gift opportunities

One of the biggest obstacles to corporate matching donations is a lack of knowledge. Software provides your nonprofit with the basic tools you need to earn matching gifts, and from there, it’s up to your organization to promote them.

You can educate your audience about matching gifts by:

- Automating your outreach. Promoting any new fundraiser requires effort on a number of fronts: creating communication templates, sending messages out, and following up with supporters. Use your CRM and matching gift software to automate your outreach. You just need to create your initial email message templates and decide what triggers will cause them to get sent.

- Sharing information on social media. Direct communication through automatic outreach is useful for supporters who are already in your donor base. Spread the word about matching gifts to a wider audience by posting educational content on social media. When promoting fundraisers online, be sure to mention the possibility of getting their gift matched since 84% of donors say they’re more likely to give if a match is available.

- Creating a landing page dedicated to matching gifts. Your supporters likely have questions about matching gifts, so answer them by creating a page dedicated to corporate matching donations. Explain what they are and what steps supporters need to take to access them. Then, embed your matching gift tool into this page.

These are just a few ways to market matching gifts, and your nonprofit should get creative with your approach to promoting them. Consider what channels your supporters use, what types of messages they respond well to, and how you can incorporate matching gifts into your regular communication strategy.

Review matching gift data to improve your approach

After launching your new matching gift promotion strategy, keep a close eye on your match rates. Take note of how many supporters check their match eligibility and what percentage of that group goes on to submit a matching gift.

Tracking where supporters drop off in the matching gift process can help you fine-tune your approach and push more gifts to completion. For instance, if you notice few supporters are using your matching gift eligibility search tool, you might reconsider where it’s placed on your donation page or if there are proper directions instructing supporters how to use it.

Examples of Corporate Matching Donation Programs

New matching gift programs regularly crop up, whether due to business owners realizing their impact or passionate employees advocating for their creation. Let’s take a look at some of the top matching gift programs currently offered by a few of the U.S.’s largest employers:

- Home Depot matches donations of $25 and up for all full and part-time employees, with an annual match cap of $3,000 per employee. All registered nonprofits in the U.S. and Canada are eligible for donations, and employees have until January 31st of the year following when the donation was made to get their match applications submitted.

- Microsoft has both an employee matching gift program and a volunteer grant program. Each employee can have up to $15,000 matched per year, and for employees who volunteer, Microsoft will donate $25 per hour to the nonprofits they donate their time to.

- General Electric matches up to $5,000 per employee per year, but be conscious of their extensive eligibility guidelines. Religious and political nonprofit organizations are excluded, as well as nonprofits operated by General Electric, as they already receive funding from the corporation.

- American Express offers matching gifts for full-time, part-time, and retired employees. Unlike many matching gift programs, American Express asks nonprofits to also fill out a form to confirm matching gift requests. This form asks for basic contact information, a donation receipt, a copy of the nonprofit’s IRS Federal Tax Exempt Letter, and a brochure that describes the nonprofit’s mission and programming.

Of course, businesses of all sizes can launch matching gift programs. Some will have minimal restrictions and even trust employees to submit the donation match themselves through a company credit card, while others have a rigorous application process to ensure the nonprofit receiving the gift is legitimate.

Whatever the program guidelines, make sure your nonprofit is ready to help donors complete their matching gift requests.

Wrapping Up: Corporate Matching Donations in Review

Corporate matching donations are a win for donors by enabling them to give more, a win for businesses by increasing their CSR impact, and a win for nonprofits by providing more revenue. To set your nonprofit up to earn more matching gifts, provide supporters with the information they need and invest in software to make the process as easy as possible.

Interested in learning more about corporate matching gifts and other corporate funding sources? Explore these resources:

- 8 Matching Gift Metrics Every Nonprofit Should Analyze. You can only know whether your nonprofit is improving its matching gift program by tracking your results. Discover the metrics you should track.

- What Is Dollars for Doers? Everything You Need to Know. Volunteer grants are another often untapped revenue stream for nonprofits. Learn what they are and how your nonprofit can access this income source.

- Challenge Gifts: An Ultimate Guide to Winning More Donations. Need other ways to invigorate donors? Explore how challenge gifts bring in more revenue.