How to Develop a Corporate Charitable Giving Policy: A Guide

As a modern company, you’ve likely heard all about corporate giving. With 94% of major U.S. corporations planning to increase or maintain their current charitable giving programs over the next few years, corporate giving certainly isn’t just another workplace trend.

While you may already have corporate giving initiatives in place, it can be difficult for employees and nonprofits alike to participate in your program if they don’t know the specific guidelines. That’s why creating a comprehensive corporate charitable giving policy is so important.

According to recent research, only 19% of companies include more than one paragraph about matching gifts—a common corporate giving initiative—in their employee handbooks or on their websites. To make your company’s program stand out, you need a formal policy that people can easily access.

In this guide, we’ll cover the basics of corporate charitable giving policies by answering the following questions:

- What Are the Benefits of Corporate Giving?

- What Is the Purpose of a Corporate Charitable Giving Policy?

- What Should My Company Include in Its Charitable Giving Policy?

- What Types of Corporate Giving Should My Company’s Policy Offer?

- What Are Some Examples of Companies with Corporate Charitable Giving Policies?

- How Can Corporate Giving Software Help Manage My Company’s Policy?

With all of your corporate giving questions answered, you’ll be well on your way to creating an impactful, easy-to-follow policy.

What Are the Benefits of Corporate Giving?

Before we kick off with corporate charitable giving policies, it’s important to understand why companies participate in corporate giving in the first place.

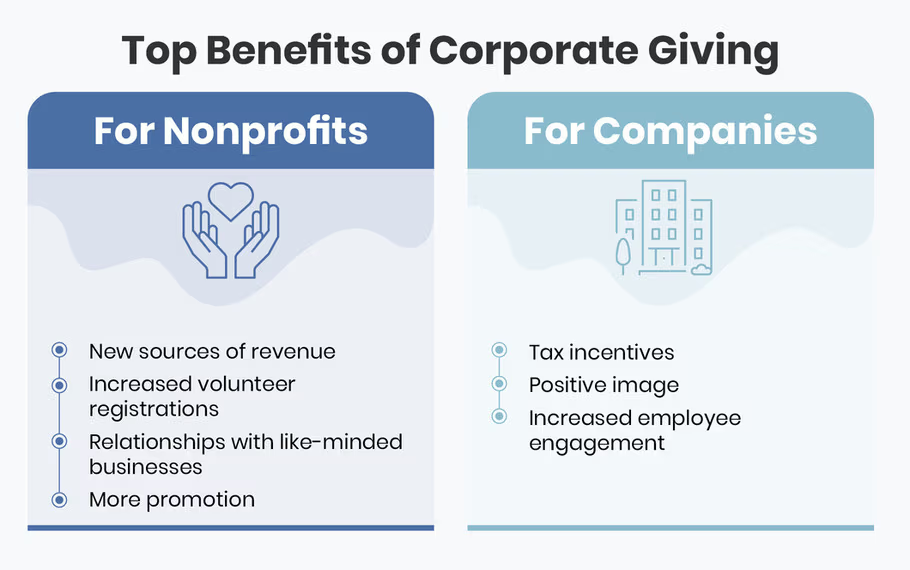

Corporate giving refers to a company’s philanthropic activities, including donations of funds, resources, or volunteer time to nonprofits, that are aimed at making a positive social or community impact. While it’s clear that nonprofits benefit from corporate giving by earning more for their causes, there are a variety of other advantages of corporate giving for these organizations, including:

- New sources of revenue. Nonprofits are always looking for ways to diversify their revenue streams. Corporate giving provides a new source of revenue for nonprofits, allowing them to rely less heavily on individual donations.

- Increased volunteer registrations. Volunteer grants, a popular form of corporate giving, encourage company employees to volunteer at their nonprofits of choice. In turn, nonprofits both earn more money for their causes and secure more volunteer support.

- Relationships with like-minded businesses. When a large number of employees contribute to a certain organization, there’s an opportunity for the company and nonprofit to form a lasting relationship, resulting in sponsorships and ongoing support.

- More promotion. Companies can use their platforms to promote the nonprofits they partner with and contribute to. As a result, nonprofits gain more publicity and support.

It makes sense that corporate giving benefits nonprofits on the receiving end, but what about the companies that support these organizations? Here are some advantages for companies that participate in corporate giving:

- Tax incentives. Most of the donations companies make to charitable organizations are tax-deductible, so companies can save money by participating in corporate giving.

- Positive image. Companies that participate in corporate giving show that they’re committed to a greater purpose that goes beyond offering a product or a service. This practice can attract customers and prospective employees looking to support companies that help those in need.

- Increased employee engagement. About 71% of employees want to work for companies that contribute to nonprofit causes. Corporate giving helps keep employees around and engages them through employee giving initiatives.

While most people think of corporate giving as solely benefiting nonprofits, this generosity creates mutually beneficial partnerships between nonprofits and companies. These relationships spark meaningful programs that help beneficiaries and encourage employees to contribute to nonprofit causes.

What Is the Purpose of a Corporate Charitable Giving Policy?

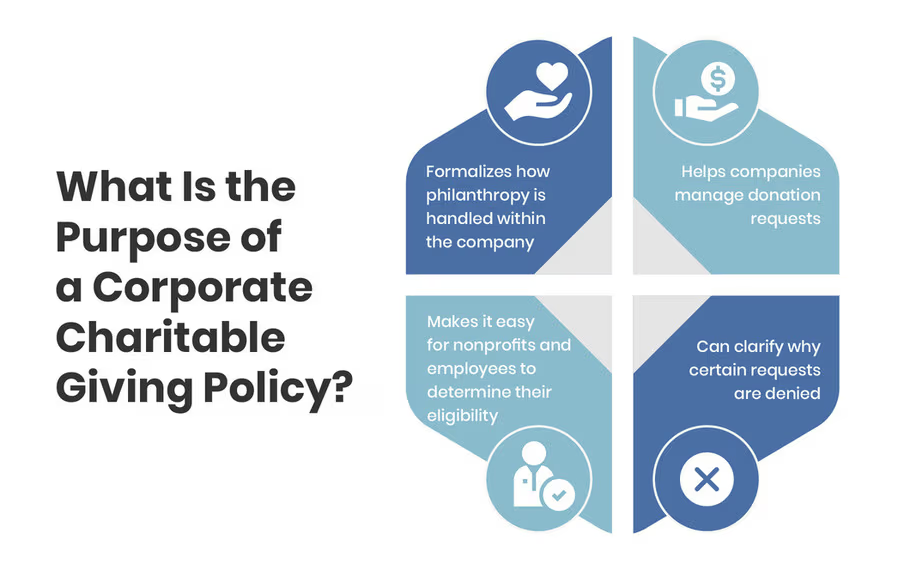

Now that you have a better understanding of why corporate giving is so valuable for nonprofits and businesses, it’s time to dive into corporate charitable giving policies. If you already have a corporate giving program, you may think it’s enough to leave it at that. While your program likely has positive effects on participating nonprofits and employees, it could be even stronger if you created a corporate charitable giving policy. Corporate charitable giving policies are necessary components of corporate giving programs because they:

- Formalize how philanthropy is handled within the company. 78% of donors are unsure whether their company offers a matching gift program and what the specifics of the program are. With a corporate charitable giving policy, you make it clear that you offer philanthropic opportunities and explain exactly how employees can get involved.

- Help companies manage donation requests. Think about how many emails flow in and out of companies each day. Without a defined process and guidelines for receiving, processing, and accepting donation requests, many requests from nonprofits will get lost in employee inboxes. A corporate charitable giving policy can outline your formal donation request process so that nonprofits know how to contact you for support.

- Make it easy for nonprofits and employees to determine their eligibility. In addition to managing donation requests, corporate charitable giving policies can help nonprofits and employees determine their eligibility for certain grants and initiatives before applying. For example, some companies only allow current employees to participate in matching gifts, so retired employees would not be eligible.

- Can clarify why certain requests are denied. If nonprofits or employees don’t check their eligibility for your program ahead of time and have their requests denied, the company can refer them to the corporate charitable giving policy so they can understand why their request was not accepted and change their approach in the future. For instance, most companies only contribute to registered 501(c)(3) organizations. If a nonprofit’s request is denied because they are not recognized as a 501(c)(3) nonprofit, then they can receive that certification and request funding again.

With a clear corporate charitable giving policy in place, your company can push its corporate philanthropy efforts forward and make it as simple as possible for nonprofits and employees to participate.

What Should My Company Include in Its Corporate Charitable Giving Policy?

When creating your corporate charitable giving policy, make it as comprehensive as possible. That way, you can save time by directing anyone with questions about your corporate giving program to your policy.

To ensure your policy has everything necessary, include the following components:

- Overview. Start your policy with a brief overview of your company’s charitable giving approach to set the tone for what people can expect from the rest of the policy.

- Point of contact. Designate who is responsible for overseeing your corporate charitable giving policy, and make sure it is clear who people can contact with any questions or concerns.

- Eligibility criteria. Make it clear what organizations and causes are eligible for your company’s support. As stated before, many companies only contribute to registered 501(c)(3) organizations, so that’s an example of an eligibility criterion you may list.

- Exclusions. If there are any specific causes your company does not contribute to, label these exclusions in your corporate charitable giving policy. For instance, many companies choose not to support any religious or political organizations, even if they have 501(c)(3) status.

- Area of focus. Some companies choose specific causes to support that align with their values. For example, The Home Depot focuses most of its corporate philanthropy efforts on three areas: veteran support, skilled tradespeople training, and natural disaster relief. When interested nonprofits see your areas of focus, they can quickly determine how likely they are to gain your company’s support based on the alignment of those areas with their missions.

- Request procedure. Include instructions for how eligible organizations or employees can request donations. You may have a specific request portal or form that you can link to in this section.

- Corporate giving programs. Explain what types of corporate giving your company offers for nonprofits and employees to take advantage of. We’ll dive deeper into different types of corporate giving in the next section.

- Matching policy. If your company includes matching gifts in its corporate giving program, detail your matching policy. To give you a better idea of what a typical matching policy looks like, 91% of companies match donations at a 1:1 ratio. Most companies also set minimum and maximum match amounts, with 93% of companies having a minimum match amount of $50 or less and 80% of companies having a maximum match amount between $500 and $10,000.

Once you’ve drafted your corporate charitable giving policy, set up a company-wide meeting to explain the policy to your employees in detail. Then, share it on your website so that nonprofits interested in partnering with your business can find it.

What Types of Corporate Giving Should My Company’s Policy Include?

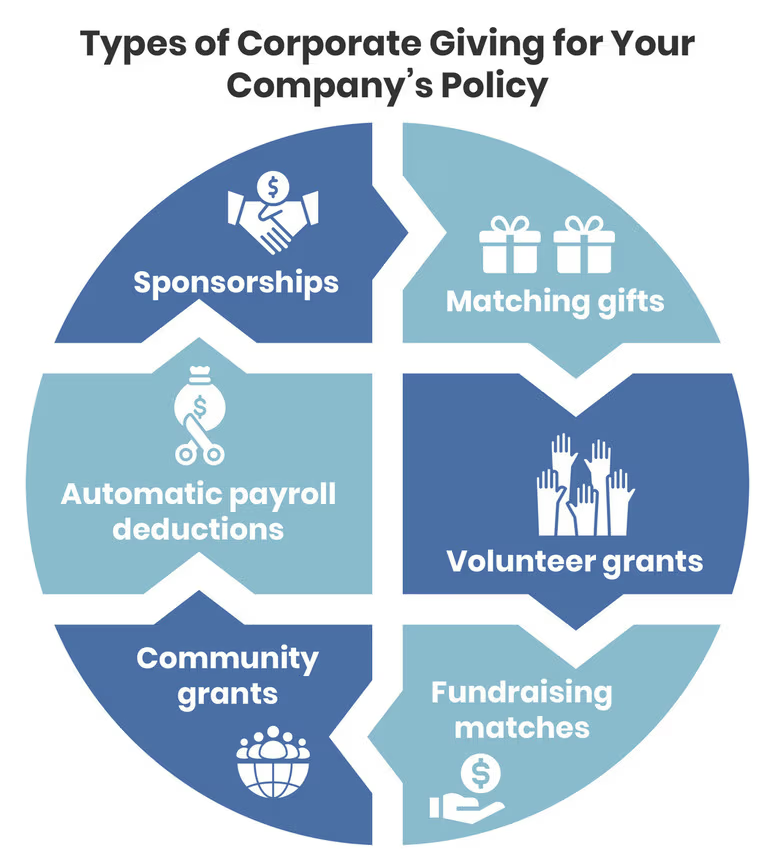

One of the main sections of your corporate charitable giving policy will be which types of corporate giving your company offers. There are so many different types of corporate giving out there for companies to leverage, so we’ve compiled a list of some of the most effective methods to narrow it down:

- Matching gifts. Matching gifts are one of the most popular forms of corporate giving, with 65% of Fortune 500 companies offering matching gift programs. When an employee whose company participates in matching gifts contributes to a nonprofit, they can send a request to have their donation matched. Then, the company matches the donation according to the matching policy outlined in their corporate charitable giving policy. Matching gifts have the potential to double or even triple the individual donation revenue for nonprofits.

- Volunteer grants. The next most popular type of corporate giving is volunteer grants, which are offered by 40% of Fortune 500 companies. Volunteer grants are similar to matching gifts, but instead of matching donations, companies contribute a certain amount to nonprofits based on how many hours their employees volunteer with these organizations. This type of corporate giving can help nonprofits raise more money and receive more volunteer support.

- Fundraising matches. Fundraising matches occur when companies match the funds their employees have raised for a certain cause. Typically, fundraising matches are reserved for events like walk-a-thons in which employees collect pledges from family and friends based on the distance they walk. After the event, the company will match the amount raised through pledges and contribute it to the nonprofit their employee is walking in support of. Some companies opt to donate a set amount to their employees’ fundraising efforts instead through a run/walk/ride sponsorship.

- Community grants. Companies that offer community grants are committed to helping local nonprofits in need, usually following a disaster or crisis. Nonprofits must seek out and apply for these grants themselves, so it’s important to include details about these grants in your corporate charitable giving policy so interested organizations know how to pursue this funding.

- Automatic payroll deductions. One of the easiest ways for employees to participate in corporate giving is through automatic payroll deductions. All they have to do is indicate which nonprofits they’d like to support and how much they’d like to give each month, and they’re set to start giving back!

- Sponsorships. Sponsorships are particularly helpful when nonprofits need additional funding for specific events, activities, or projects. Companies that sponsor nonprofits typically have an application process or sponsorship point of contact for nonprofits to leverage. While nonprofits receive funds for their current initiatives, companies see improved brand awareness through event materials and shoutouts in the nonprofits’ communications.

Consider surveying your employees to find out which corporate giving initiatives they’d be most interested in. For example, you may find that a large portion of your employees are passionate about volunteering, so volunteer grants may be a great place to start for your corporate charitable giving policy.

Discover other initiatives that will expand your charitable giving efforts by exploring our ultimate CSR strategy guide for companies just like yours.

What Are Some Examples of Companies with Corporate Charitable Giving Policies?

When you’re developing your corporate charitable giving policy, it can be helpful to look at companies’ existing policies for inspiration. Check out the policies of these three companies:

Chevron

Chevron Humankind, the company’s corporate giving program, “encourages employees and retirees to become personally involved in the communities where they live and work.” Their corporate charitable giving policy outlines their matching gift and volunteer grant guidelines.

The policy starts with a brief overview before moving into its matching policy, eligibility criteria, exclusions, and request procedure. It ends by offering a point of contact for any questions.

Chevron’s corporate charitable giving policy is a great example of a comprehensive, well-thought-out policy that touches upon every aspect of its corporate giving program. They even have a frequently asked questions document to reduce the number of communications regarding the policy. Check out Chevron’s corporate charitable giving policy here!

Starbucks

Starbucks’ corporate charitable giving policy explains the Starbucks Giving Match program, which offers matching gifts and volunteer grants. The policy contains information about the company’s matching policy, eligibility criteria, exclusions, and request procedure.

While not as comprehensive as Chevron’s policy, Starbucks’ corporate charitable giving policy still makes it clear how its employees can participate. Plus, they note that there is a fuller description of the program on the Starbucks Benefits Center, a website only Starbucks employees have access to. Check out Starbucks’ corporate charitable giving policy here!

Verizon

Through the Verizon Matching Incentive Program, employees can have their donations to nonprofits and schools matched by the company. This corporate charitable giving policy begins with a program overview. It then includes a matching policy, eligibility criteria, request procedure, and exclusions.

What stands out about Verizon’s corporate charitable giving policy is that it includes a definitions section that clarifies what each important term means in the context of the program. For example, they define a donor as “an Eligible Employee or an Eligible Retiree making a charitable donation and seeking a match from the Verizon Foundation pursuant to the Verizon Matching Incentive Program.” Check out Verizon’s corporate charitable giving policy here!

How Can Corporate Giving Software Help Manage My Company’s Policy?

Creating a corporate charitable giving policy is an important stepping stone to fortifying your corporate giving program. However, there’s one last thing you can do to ensure your program is as strong as it can be: leverage corporate giving software.

Corporate giving software, also known as Corporate Social Responsibility (CSR) software, allows you to organize all of the components of your program in one centralized database. It can help you build your corporate charitable giving policy and manage a variety of different corporate giving initiatives, including:

- Employee donations

- Automatic payroll deductions

- Matching gift requests

- Volunteer hour logs

- Volunteer grant requests

- Volunteer opportunities

- Company corporate giving metrics

When you implement corporate giving software, you also make it easier for your employees to get involved since all the tools they need are in one place. To simplify participation for your employees even further, look for software that integrates with auto-submission tools.

Auto-submission streamlines the donation match request process for employees. Instead of filling out a complete donation request form, employees can simply search for their company in a matching gift database and enter their corporate email address. Then, the platform will automatically send a matching gift request to the employer on the donors’ behalf.

When you choose workplace giving software that works in tandem with these tools, you ensure as many employees as possible are participating in your corporate giving program, allowing you to maximize support for worthy nonprofits.

Additional Resources

A corporate charitable giving policy is what ties your entire corporate giving program together. It provides focus to your program and allows employees and nonprofits to participate effectively. As a result, your company can adhere to its values and actively contribute to causes its employees and community care about.

If you’d like to strengthen your corporate giving program even further, check out the following resources:

- What Is Workplace Giving For Companies & Why Does It Matter? Your corporate giving software will likely enable you to run workplace giving programs. Discover why this form of CSR is so important and learn how to get started.

- Winning Workplace Giving Strategies & How to Leverage Them. There are so many ways to get your employees involved in your company’s philanthropy. This article explains a variety of workplace giving strategies your business can implement.

- How to Start a Matching Gift Program [For Companies]. Is your corporate giving program missing matching gifts? Incorporate matching gifts into your existing corporate giving initiatives using these tips.