Matching Gift Eligibility: What Your Donors Should Know

A whopping 26 million individuals work for companies that offer matching gift programs. However, only 8% of donors know whether their employer offers matching gifts, their eligibility status, and how to apply for a matching gift.

Information about matching gift programs is often easily accessible, but many supporters don’t know to look for it or whether doing so is even worthwhile. After all, how can they know if they’re matching gift eligible or not?

Every company has its own rules for matching gift eligibility, meaning your nonprofit won’t be able to make blanket statements that apply to all donors. However, you can point them in the right direction by arming them with the basics about who usually qualities for a matching gift.

To make sure you and your donors are on the same page about matching gift eligibility, we’ll explore five common criteria most businesses use. Then, we’ll dive into how your nonprofit can help donors confirm their eligibility with matching gift software.

1. Nonprofit Status

Matching gifts are intended for nonprofit organizations. As such, nonprofits need to be registered 501(c)(3) for U.S.-based organizations or the equivalent in their country. If your organization has yet to complete this process, donations you collect will not be tax-exempt and matching gift applications to your organization will likely be denied.

The exception is for organizations operating under a fiscal sponsorship. The nonprofit incubator or change accelerator overseeing your organization can accept matching gift donations on your behalf. However, some fiscal sponsorships may require you to notify them about the incoming donation to ensure it is properly processed. If you have questions about how your specific fiscal sponsor handles matching gifts, reach out to them.

If your nonprofit’s 501(c)(3) status is revoked for any reason, you will no longer be able to receive matching gifts and subsequent donations will be taxed. In this situation, take the following steps:

- Do continue soliciting donations. You can still accept donations even if you are no longer a registered nonprofit. However, be transparent with donors and update any language on your website, social media, or other outreach channels that refers to your organization as tax-exempt or implies donations are tax deductible. At this stage, pause requesting matching gifts as employers are likely to deny the applications. Additionally, for full transparency, add a note to your website explaining the situation to ensure donors are aware of the situation and prevent potential penalties for fraud.

- Verify status as a nonprofit corporation. In most cases, your nonprofit will not need to re-file its Articles of Incorporation. However, do check that your nonprofit’s corporate status is still active in your state. If not, such as in the event of breaching your state’s requirement, you may need to file a new Articles of Incorporation before applying for 501(c)(3) status.

- Apply for status reinstatement. To re-apply for nonprofit status, file a Form 1023 with the IRS. On the form, state that you are requesting a reinstatement rather than filing for the first time. If you have missed any previous Form 990 filings, you will need to refile for each year missed.

If your application is approved, your nonprofit will be reinstated as an official 501(c)(3). At this point, you can resume promoting and receiving matching gifts.

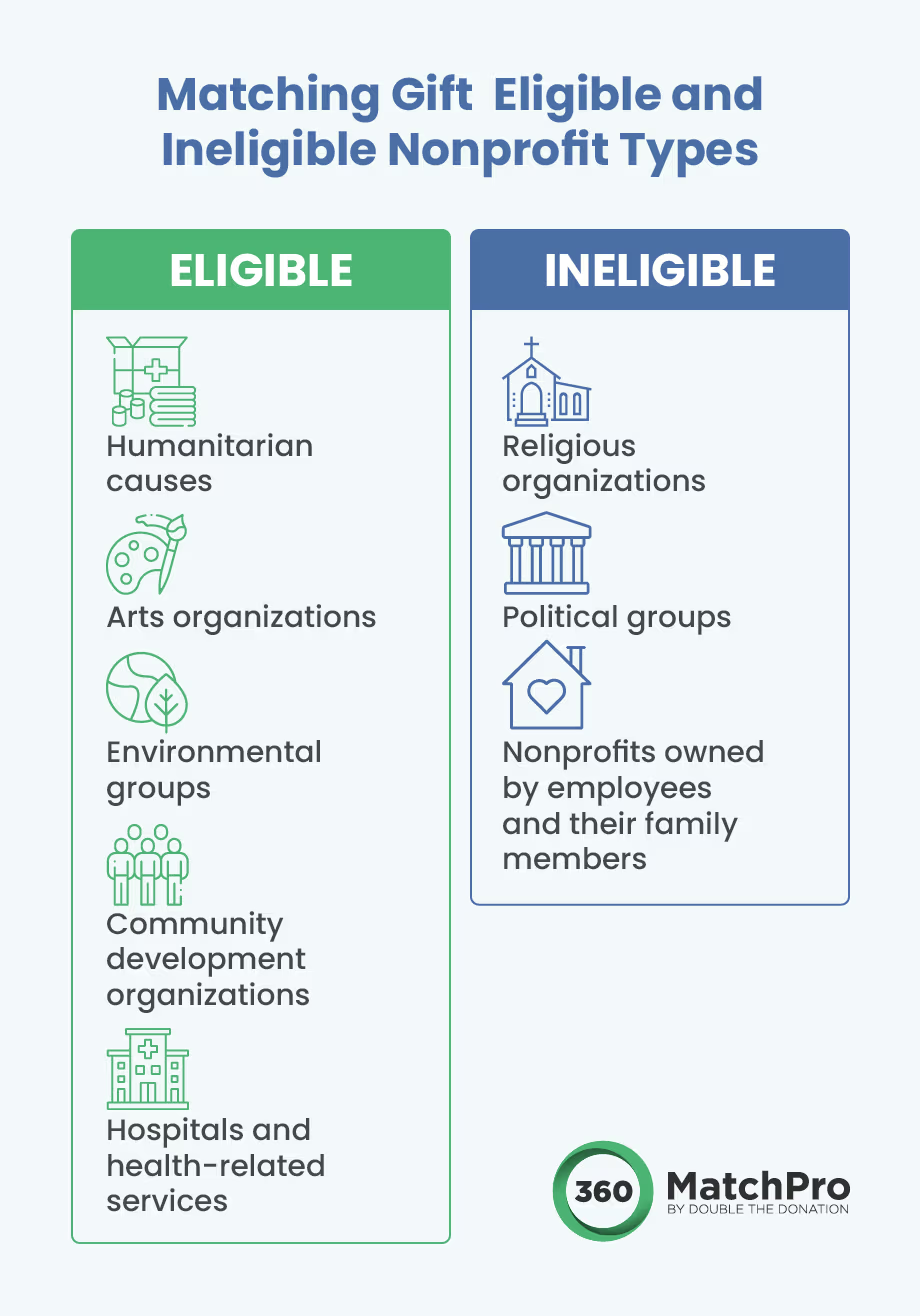

2. Type of Nonprofit

Different businesses match donations to different types of nonprofits. Some employers have more stringent guidelines and may limit matching gift eligibility to just a few types of organizations, while others match gifts to any registered 501(c)(3).

However, there are a few common trends in which types of nonprofits are eligible.

Commonly Eligible Nonprofits

For the most part, the average matching gift program will approve gifts to the following types of nonprofits:

- Humanitarian causes

- Arts organizations

- Environmental groups

- Community development organizations

- Hospitals and health-related services

Most businesses also will approve matching gifts to schools and higher education institutions. However, it’s worth noting that many also have special or separate programs for schools. For example, accounting firm Deloitte matches employee gifts of up to $7,500 for nonprofit organizations but has a higher cap of $25,000 for higher education institutions, including universities, community colleges, and professional and graduate schools.

Commonly Ineligible Nonprofits

While some businesses limit what types of nonprofits they match gifts for to focus employee donations, many others bar certain types of nonprofits to avoid conflicts of interest and controversy.

As such, the following types of nonprofits are often ineligible for matching gifts:

- Religious organizations including churches, youth groups, and other religious-oriented nonprofits.

- Political groups, particularly donations to partisan groups or political candidate’s campaigns. Nonprofits that conduct advocacy campaigns or provide support to grassroots groups are usually okay, as long as they remain nonpartisan.

- Nonprofits owned by employees and their family members are exempt to avoid conflicts of interest and potential abuse of the matching gift system.

In most cases, it will be relatively clear whether your nonprofit’s organization type is eligible for a specific company’s matching gift program. If donors have questions, be prepared to send them information about your mission, such as a pamphlet explaining your programming, that their employers can use to verify your organization.

3. Employee Status

Many companies offer matching gift programs to some but not all of their employees. Encourage donors to assess their employer’s matching gift guidelines to ensure their employment status qualifies them for a matching gift.

Sometimes, supporters who previously assumed they were ineligible actually do qualify for a matching gift. For example, many corporations have matching gift programs that allow the following individuals to have their donations matched:

- Full-time

- Part-time

- Retirees

- Spouses of employees

Additionally, some businesses also require donors to have been employed for a certain length of time, such as six months or a year, before their gifts will be matched. Donors can find specific details by looking into their employee handbooks or their employer’s CSR platform. Alternatively, they can ask the appropriate parties at their place of employment for more information.

4. Matching Gift Amounts

Many employers implement minimum and maximum donation requirements for matching gifts. These limitations push donors to give more (in the case of minimums) while also preventing the company from going over budget on matching gift approvals (in the case of maximums).

Maximum and minimum criteria are incredibly widespread across matching gift programs. Take a look at the max match amounts from some of the top companies that offer matching gift programs:

- Matching Gift Company

- Sanofi

- Gingko Bioworks

- Deloitte

- Soros Fund Management

- Gap Corporation

- Johnson & Johnson

- Match Ratio

- 1:1

- 1:1

- 1:1

- 3:1

- 1:1

- 2:1

- Max Match Amount

- $5,000

- $2,500

- $3,000

- $300,000

- $10,000

- $20,000

Also notable in this chart is the matching gift ratios. For instance, Johnson & Johnson matches employee donations at a 2:1 ratio while Soros Fund Management and ExxonMobile offer an impressive 3:1 ratio. This means for every $1 an employee gives, their employer gives an additional $3, effectively quadrupling their gifts.

Companies with high maximums and matching gift ratios above the normal 1:1 are especially valuable in the case of major donors. Encourage all donors, especially those giving in high amounts, to check their matching gift eligibility. Even if only part of their gift will be matched, that’s still free extra revenue for your nonprofit.

Additionally, take note that matching gift maximums are usually per employee per year. This means a donor might reach their matching gift limit by making one $5,000 donation to your nonprofit or by making ten $500 donations to different organizations throughout the year.

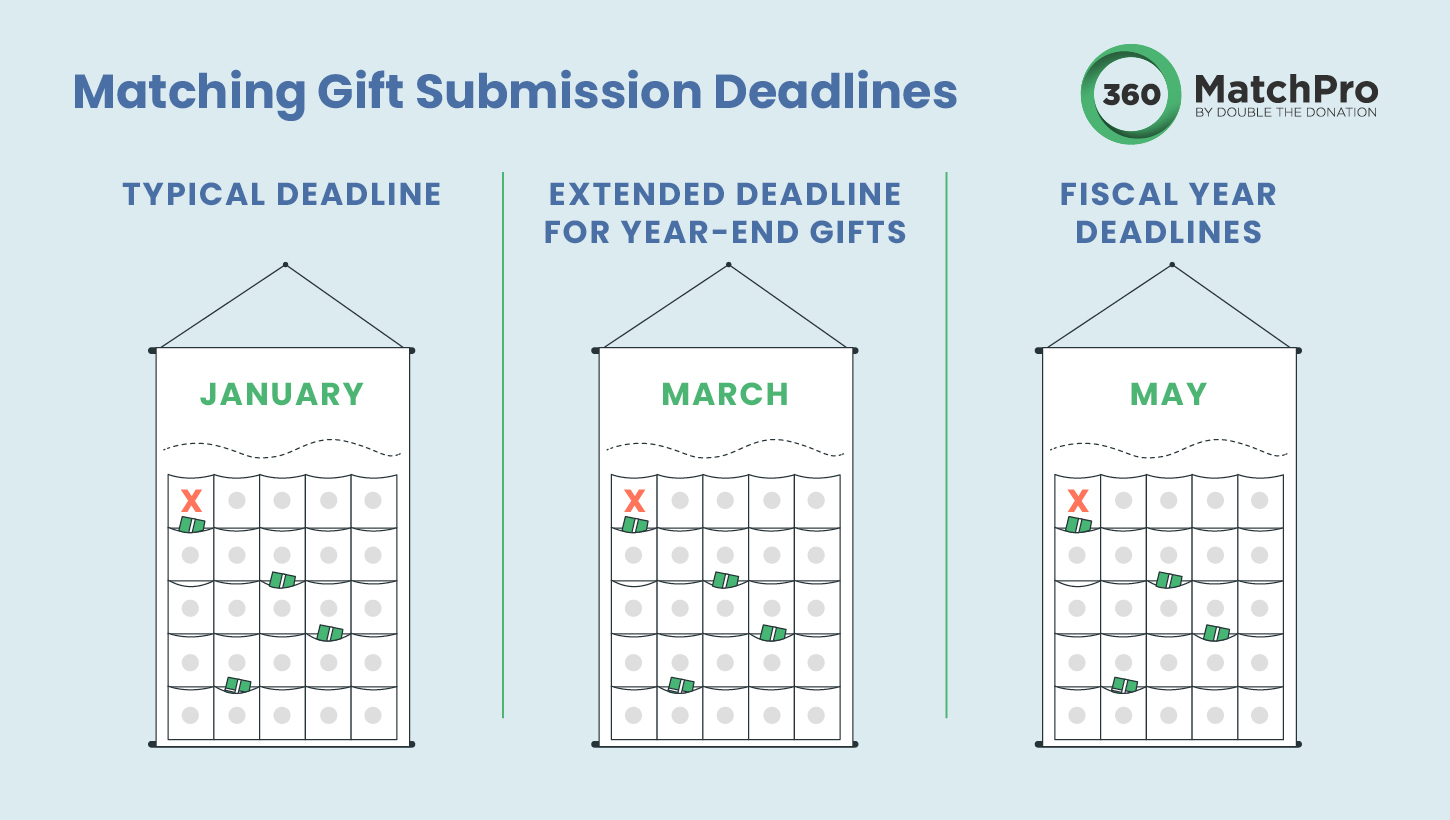

5. Submission Date

After a donor gives to your nonprofit, they don’t necessarily need to submit a matching gift application right away. However, the faster they do, the quicker your nonprofit will receive the matched donation from their employer and the less likely they are to miss a submission deadline.

Employers have deadlines for when matching gift applications must be submitted to stay organized, prevent backlogs of donation requests, and encourage employees to act quickly when they give. Typically, these submission deadlines are:

- January 1st. Midnight on January 1st signals a new year and is one of the most common matching gift application deadline dates. Be especially wary of this deadline when it comes to the busy year-end giving season. Many last-minute or holiday donors may qualify for a matching gift, so be sure to promote matching gifts more proactively during this time of year.

- A few months after January 1st. Many businesses are aware of the end-of-year giving rush and extend their matching gift application deadlines a few months after January 1st, usually to some time between February and April of the following year. Occasionally, businesses will stick to a January 1st deadline for gifts made during the majority of the year but have special extended application deadlines for donations made in the weeks before January 1st.

- End of the company’s fiscal year. Rather than operating on the calendar year, some businesses require employees to follow their fiscal year for matching gift applications. While every business is different, many businesses’ fiscal years revolve around tax season and end sometime in April or May.

Accounting for each donor’s matching gift submission deadline is far from practical. However, generally reminding them to submit their matching gift applications will prevent them from missing their chance altogether.

You can do this by following up with match-eligible donors after they make their gifts. With matching gift software, like 360MatchPro, your nonprofit can track where donors are in the matching gift process and ensure they drive their gifts to completion.

How Matching Gift Software Helps Donors’ Discover Their Eligibility

Your nonprofit doesn’t need specialized software to be eligible for corporate matching gifts, but encouraging donors to pursue matching gift opportunities is much more difficult without it.

Your matching gift software provider will not only provide you with the tools your donors need to complete their gift requests but also walk you through how to set up your new platform and integrate it with your current donation forms and fundraising software.

But first, before you can connect with a vendor that will educate your nonprofit on how best to use matching gift technology, you need to pick a software solution. We recommend looking for matching gift software with the following features:

Matching Gift Database

A matching gift database is a hub of information about employer matching gift programs, and, as such, it’s your most valuable tool for helping donors determine their matching gift eligibility. When researching matching gift software, pay special attention to their database, and select a platform with a database that has:

- Easy setup. Setting up your matching gift database should be an easy and convenient process. Pick a platform with many fundraising software integrations, like 360MatchPro, to easily connect your new software to the rest of your tech stack.

- User-friendly interface. Donors should be able to easily navigate your matching gift database on the front end to find the information they’re looking for. Find a database that lets you customize its appearance to brand it to your organization, allowing you to create a cohesive and professional experience for donors.

- Comprehensive company records. Your matching gift database is only useful if it has the information your donors are looking for. Pick software that contains comprehensive company records to help as many of your donors find their matching gift information as possible. For reference, Double the Donation is proud to offer a matching gift database that covers 99% of U.S. and 95% of Canadian corporate matching gift programs.

- Frequent updates. New matching gift programs are launched and old ones are changed constantly. Partner with a matching gift software provider that keeps their database up-to-date to ensure you provide donors with the correct information.

- Software support. Choose a provider you know you can rely on in the event of technical issues. Basic software support services to look for include a thorough onboarding process and a fast, reliable ticket system.

- Volunteer grant information. Volunteer grants, also known as Dollars for Doers, are another type of corporate giving program closely linked to matching gifts. Rather than matching supporters’ donations, companies instead donate based on how many hours their employees volunteer. Some software vendors also provide information about these programs alongside employee matching gift information.

If you have questions about how a specific matching gift database works, reach out to the vendor and request a demo. Our team at Double the Donation is always happy to answer questions and walk nonprofits through how to use their new, game-changing software.

Auto-Submission

Matching gifts might be an old concept, dating back to 1954, but the technology continues to evolve. The latest advancement in matching gift software is auto-submission functionality.

The process of filling out an employer’s matching gift application is often the biggest hurdle in driving matching gifts to completion. These forms ask supporters to provide much of the same information they did during the initial donation process, and after going through the effort of donating, many supporters put off having to fill out even more paperwork.

This is where auto-submission comes in. Employers that enable auto-submission through their CSR software allow their employees to complete their matching gift applications automatically. Essentially the process looks like this:

- A donor gives to a nonprofit with 360MatchPro. Currently, 360MatchPro is the only matching gift provider to offer matching gift auto-submission services, meaning nonprofits without matching gift software or who use a different provider won’t be able to access auto-submission.

- The donor provides their corporate email address. From there, 360MatchPro will identify if the donor’s employer allows auto-submission, and if they do, the donor will be asked if they would like to have their matching gift request automatically processed for them.

- The matching gift request is sent to the employer for approval. Donors don’t need to take any additional steps at this point, and your nonprofit just needs to reach out to thank them for requesting a matching gift.

If you’re curious about how this technology works and what it can do for your nonprofit, check out this video by our team:

Follow-Up Communication

Nonprofits have three jobs when it comes to promoting matching gifts after a donor gives. First, they need to ask donors to check their matching gift eligibility. Next, they should follow up with donors to ensure they submit a matching gift request before their employers’ deadlines. And last, they should thank donors for going the extra mile to help their cause by applying for a matching gift.

Your matching gift software can help with each of these steps through automated follow-up communication tools. Software like 360MatchPro allows nonprofits to send automated matching gift messages in response to trigger actions, such as entering a corporate email address and time passing after a donation without receiving a matching gift.

This allows you to check in with donors throughout the matching gift process to make sure donations aren’t forgotten about and as many matching gift applications are submitted as possible.

Matching Gift Eligibility: More Resources

When it comes to matching eligibility, your nonprofit’s role is to answer supporters’ questions, provide them with the resources they need, and encourage them to continue their research until they get an answer. As such, your first step is to make sure your team has the knowledge about matching gifts you need to help supporters.

Take that first step by continuing your research with these resources:

- What Is Dollars for Doers? Everything You Need to Know. Donors who qualify for matching gifts likely also qualify for volunteer grants, also known as dollars for doers. Discover yet another source of revenue your supporters can tap into.

- How to Market Matching Gifts: The Comprehensive FAQ Guide. Supporters need to know about matching gifts before they can check their eligibility! Learn how you can promote matching gifts to your audiences.

- Challenge Gifts: An Ultimate Guide to Winning More Donations. Energize your donors to give even more with challenge gifts. Get acquainted with this fundraising strategy and how it intersects with matching gifts.